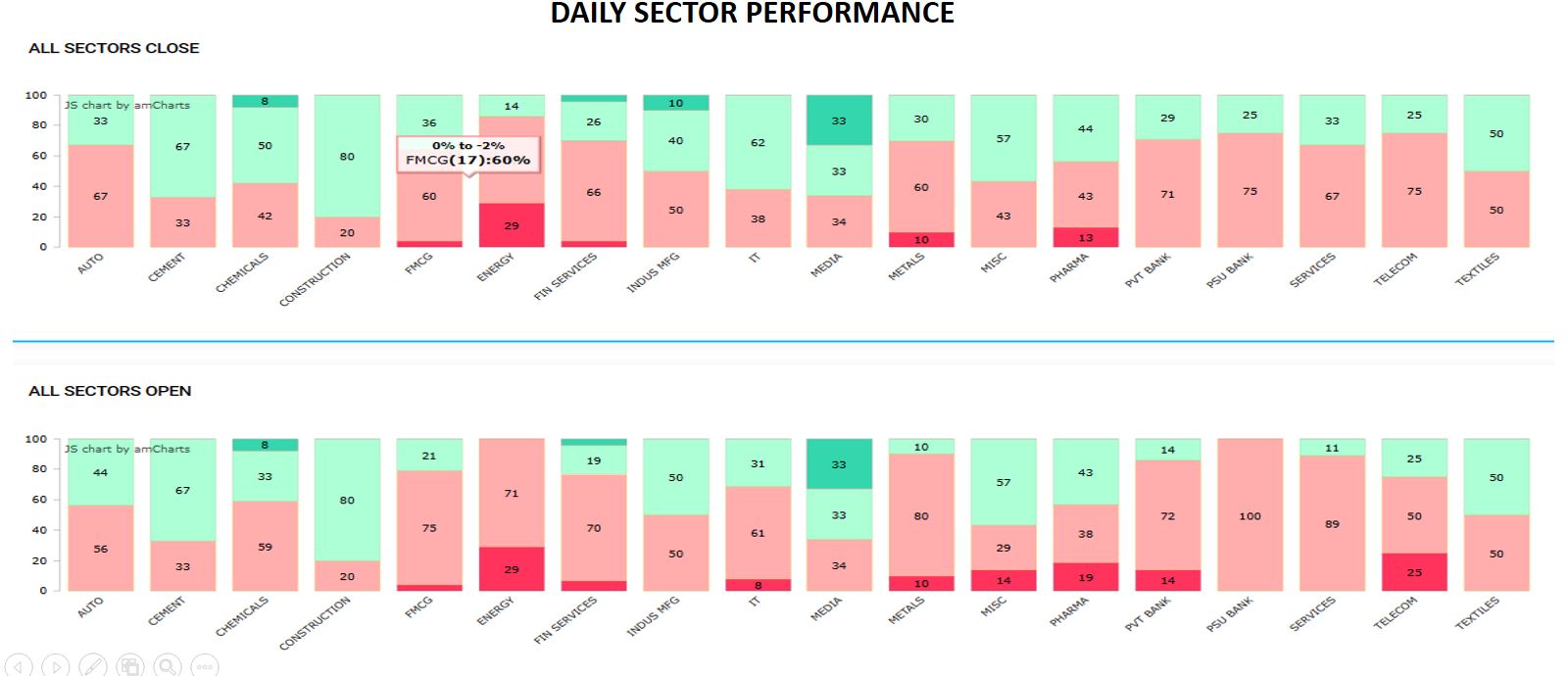

The strong sell-off seen during expiry has once again created a problem for the entire market thus causing a lot of turbulence across the sectors. The constant selling pressure that we are currently facing is a clear indication of a sustained bearish bias that is emerging. As we await some inflation and macro numbers from the US markets we need to see how much of a role that shall play. Also, the IT major’s results could help influence some positive vibe that one is expecting to challenge the bearish camp.

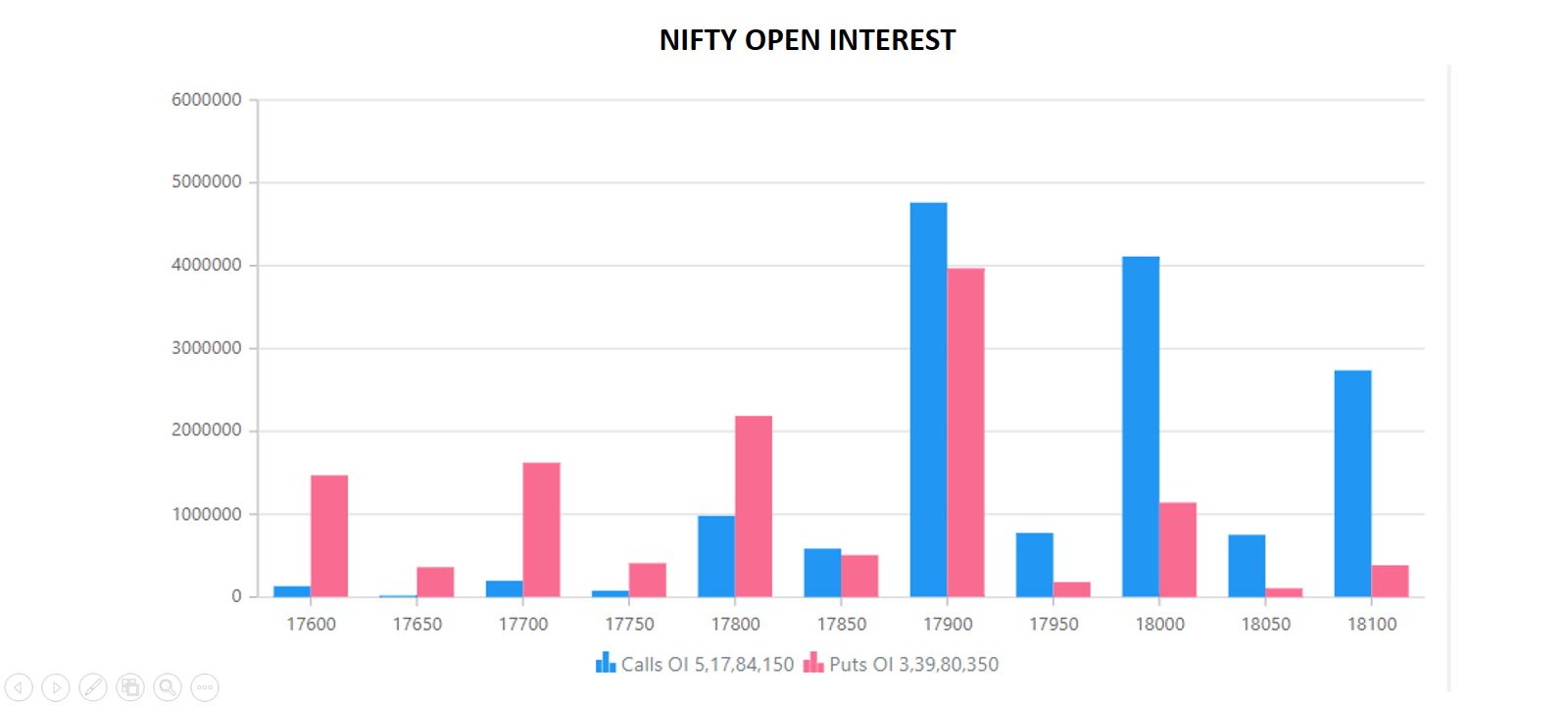

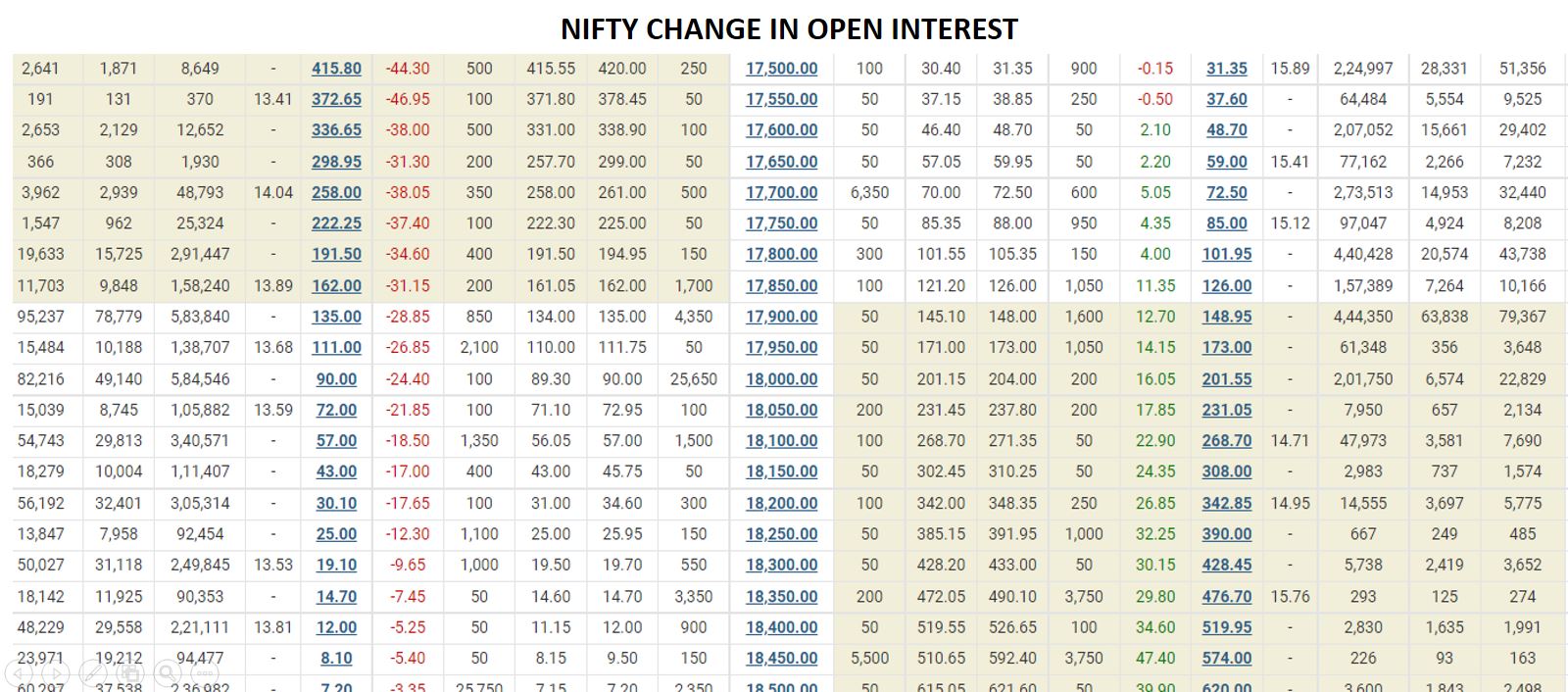

Constant call writing at 17900 is indicating that the trends are pressured also we note that the change in Open Interest is more on the Call side indicating that there is call writing happening at the moment that will retain control. Higher levels around 18100-18150 would remain a resistance zone.

A large quantity of traders were seen converting their positions on the short side today at the level of 18000, as more positions were built at the 17900, 18000 and 18100 levels making it evident for the nifty to have a downside fall.

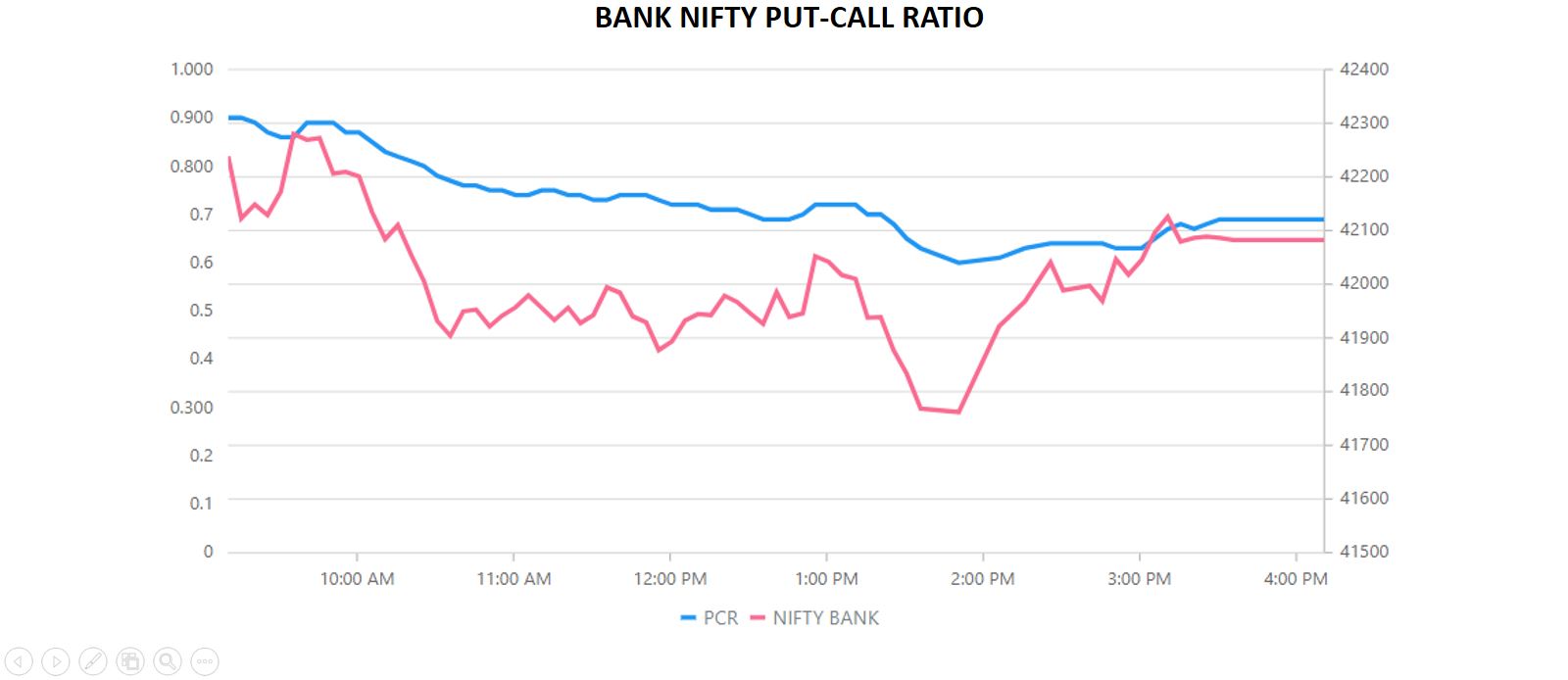

A steady decline was seen in the put call ratio as the markets trimmed we saw equal number of buyers to sellers now as the markets coming below its 0.6 oversold pcr. Yet the downfall kept the sellers on their seat in spite the decline on pcr.

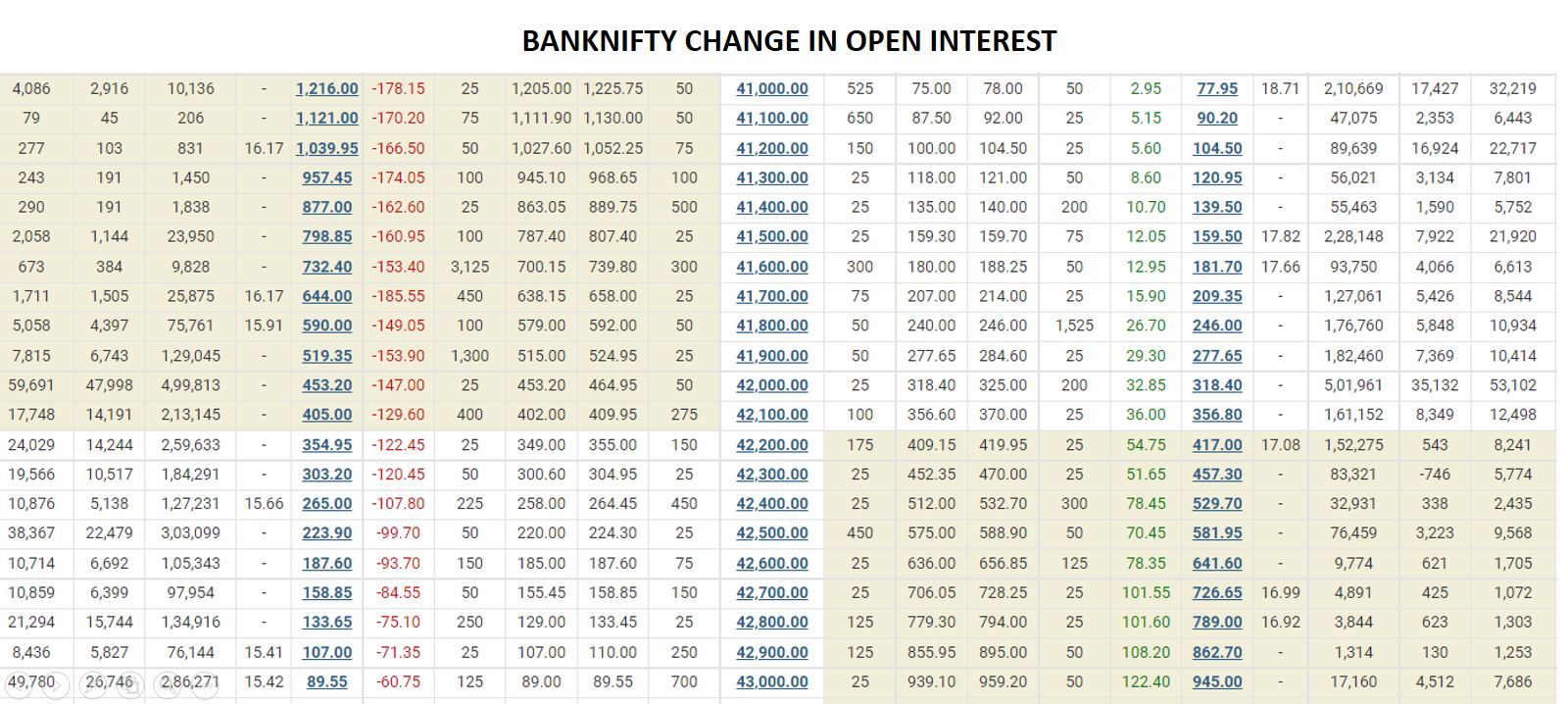

The top 4 stocks of Bank Nifty around 70 % by weight has undergone considerable weakness indicating that the trends are pressured to the downside

Comparatively Bank Nifty is not witnessing much short position on either side and is looking to hold back the support zones as we head into the last trading day of the week. Challenges continue to remain. However, looking at the overall setup and details we can conclude that the trends are trying to revive. Hence one needs to keep a threshold of the first 30 minutes of the day and take a suitable decision when the bounds are given away.