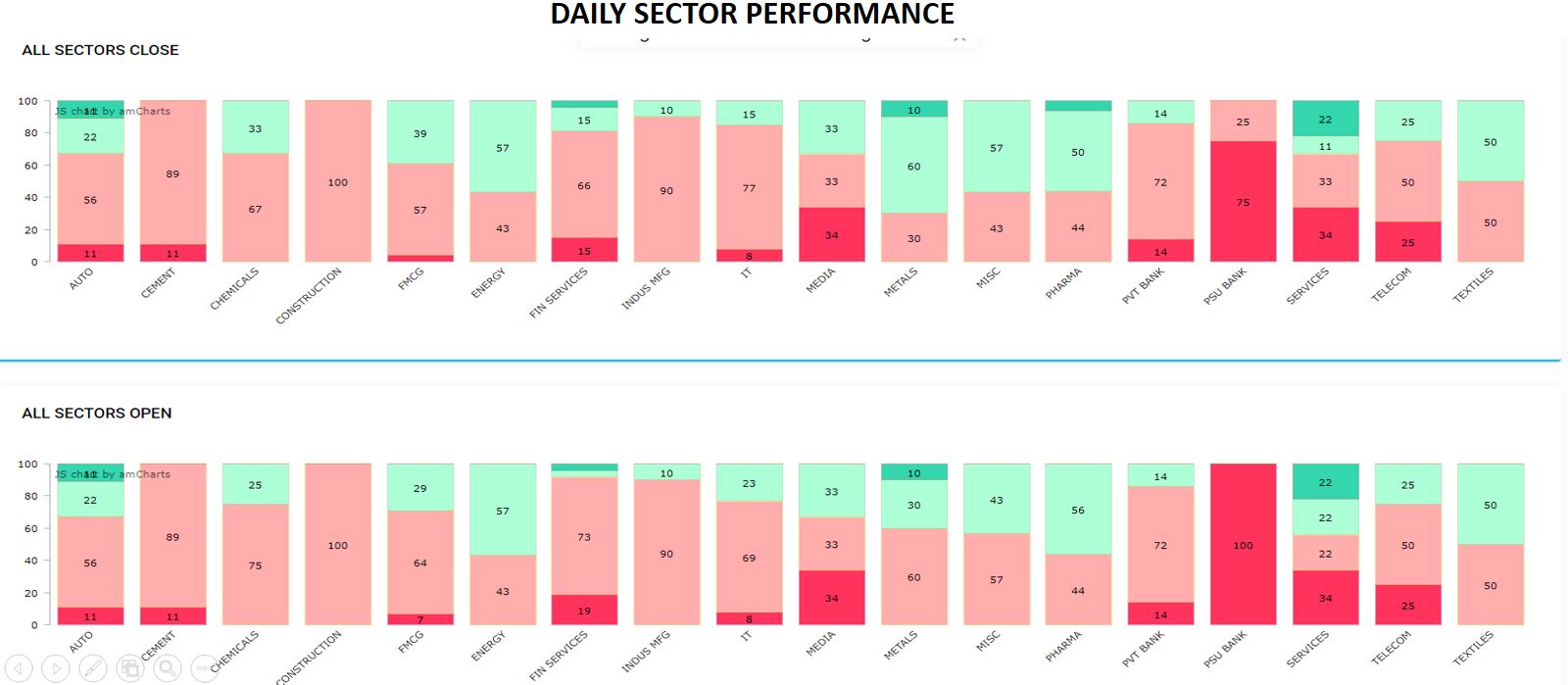

The trends across all the sectors remained muted and the bearish presure Last week saw a majority of the sectors underperform through out the week thus dragging the indices lower. Amongst the sectors IT, Metals and Banking stocks were the weakest and have been instrumental in dragging the index lower.

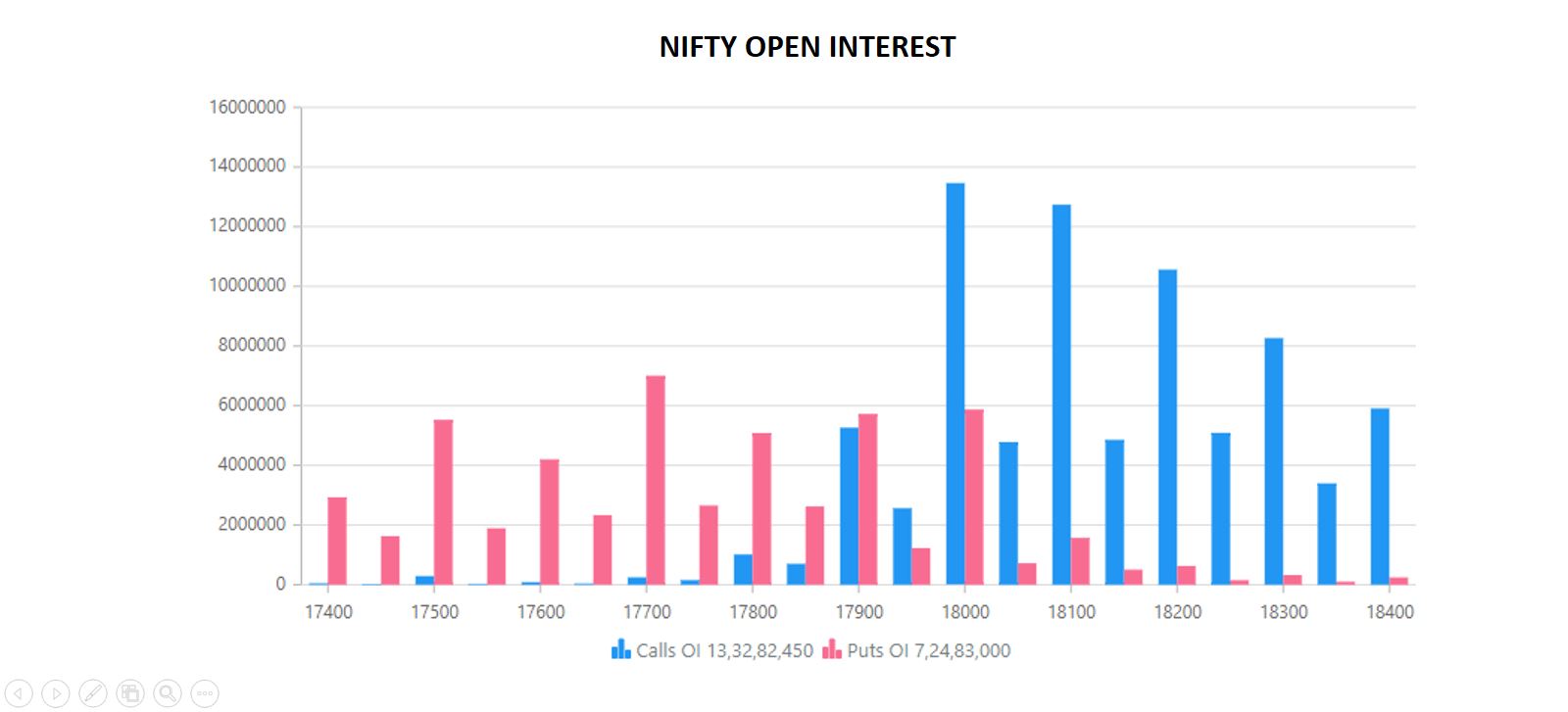

Strong selling pressure seen over the last two days is now testing the gap region.

Strong call writing at 18000 level suggests that the road ahead could be a challenging one. The Max Pain is now moved to 18000 from 18050 that was held for a while that indicates that the Sellers are in control.

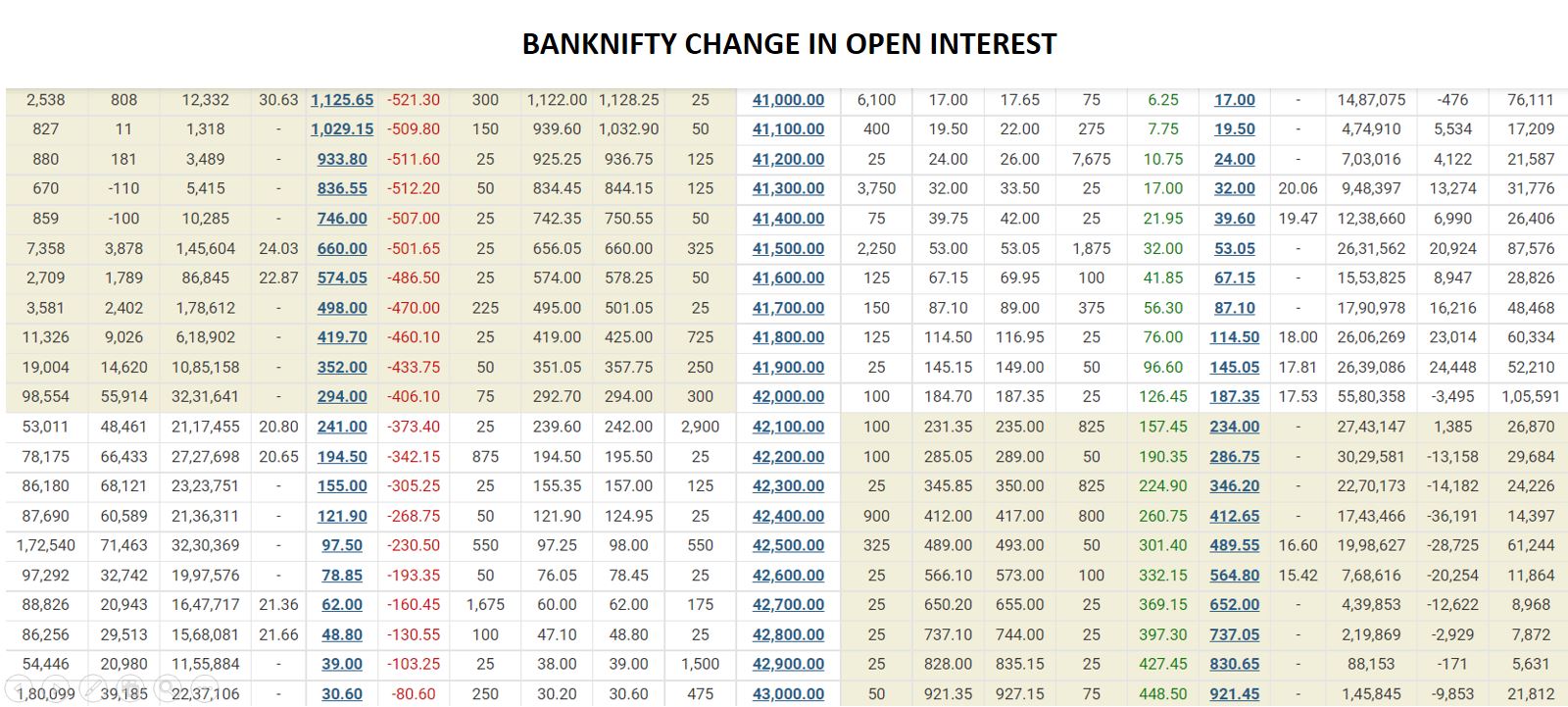

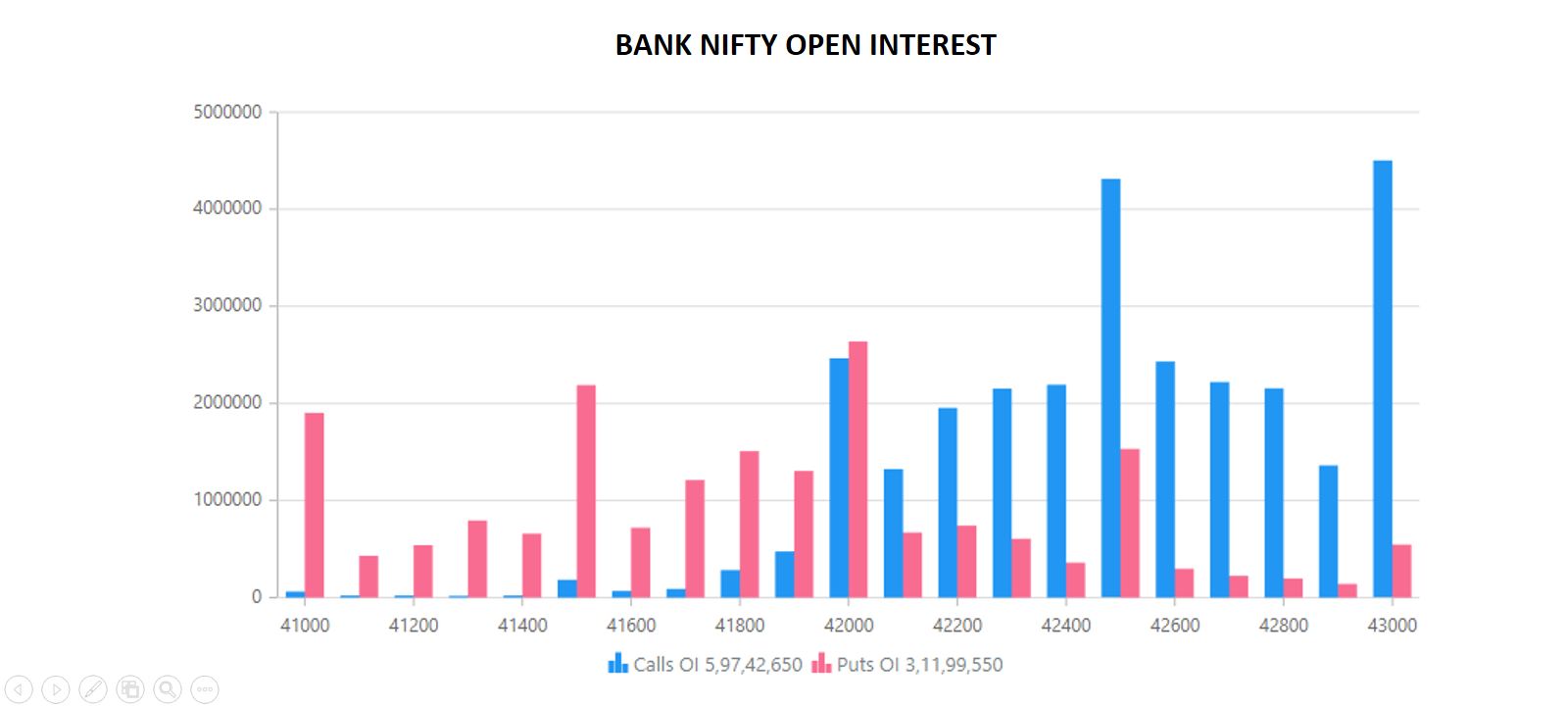

Bank Nifty could not generate enough momentum to the upside and it is now forced to test the lower levels around 42000 forming a very wide channel. Lower levels are being questioned and this could decide the way ahead for the trends.

OPEN INTEREST:- A huge number of calls were added at the 43000 level depicting the market being in complete control of the sellers. 43000 would be acting as the strongest resistance zone giving the buyers a hard time penetrating this level.

However, the PCR suggests that we have reached an oversold status and is hinting at the indices displaying a rebound.