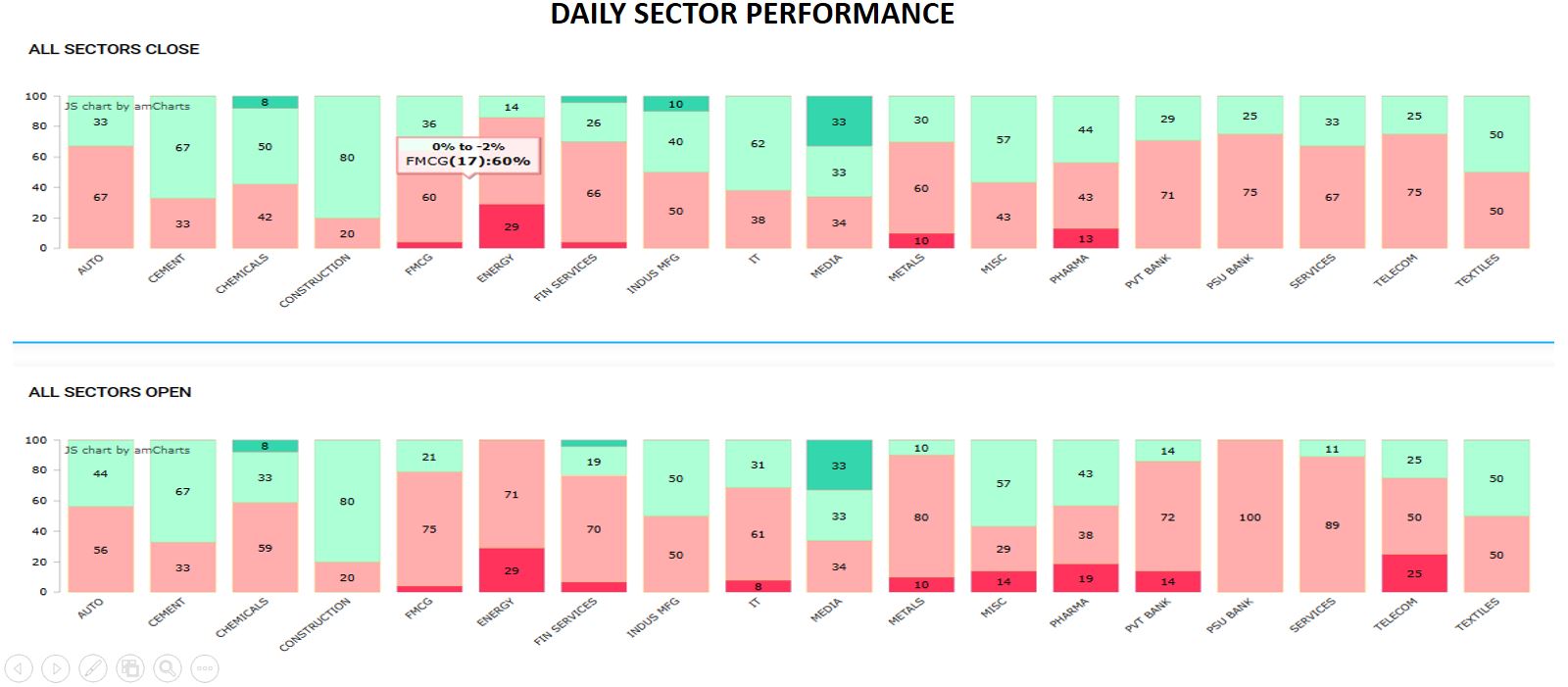

Last week saw a majority of the sectors underperform through out the week thus dragging the indices lower. Amongst the sectors IT, Metals and Banking stocks were the weakest and have been instrumental in dragging the index lower.

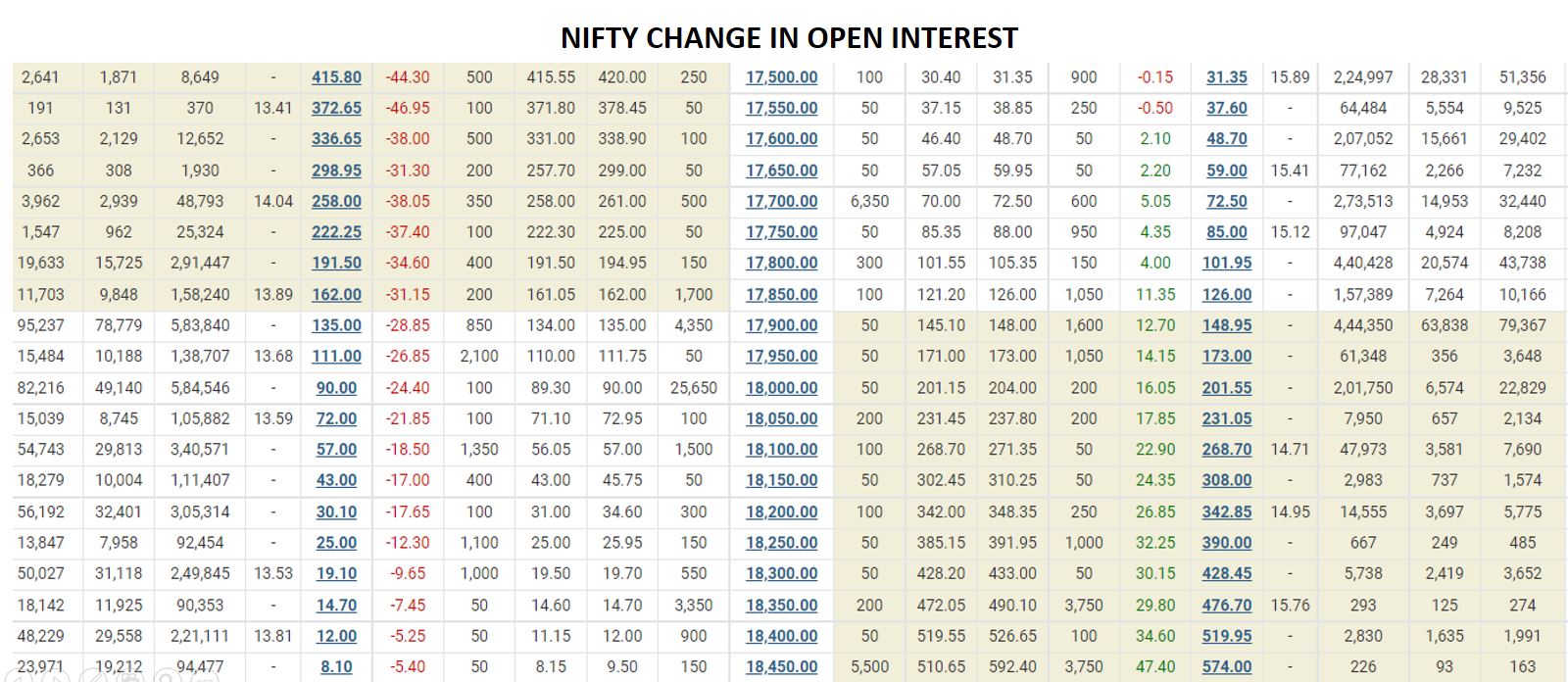

The sharp decline in the earlier part of the day was soon retraced but a smart recovery towards the close of the day. The supports indicated yesterday around 17800-900 continue to be an important area to watch out for. A new range of V shape recovery was seen by ending the day slightly bearish from where it started. The higher levels will continue to remain an attraction for the short sellers.

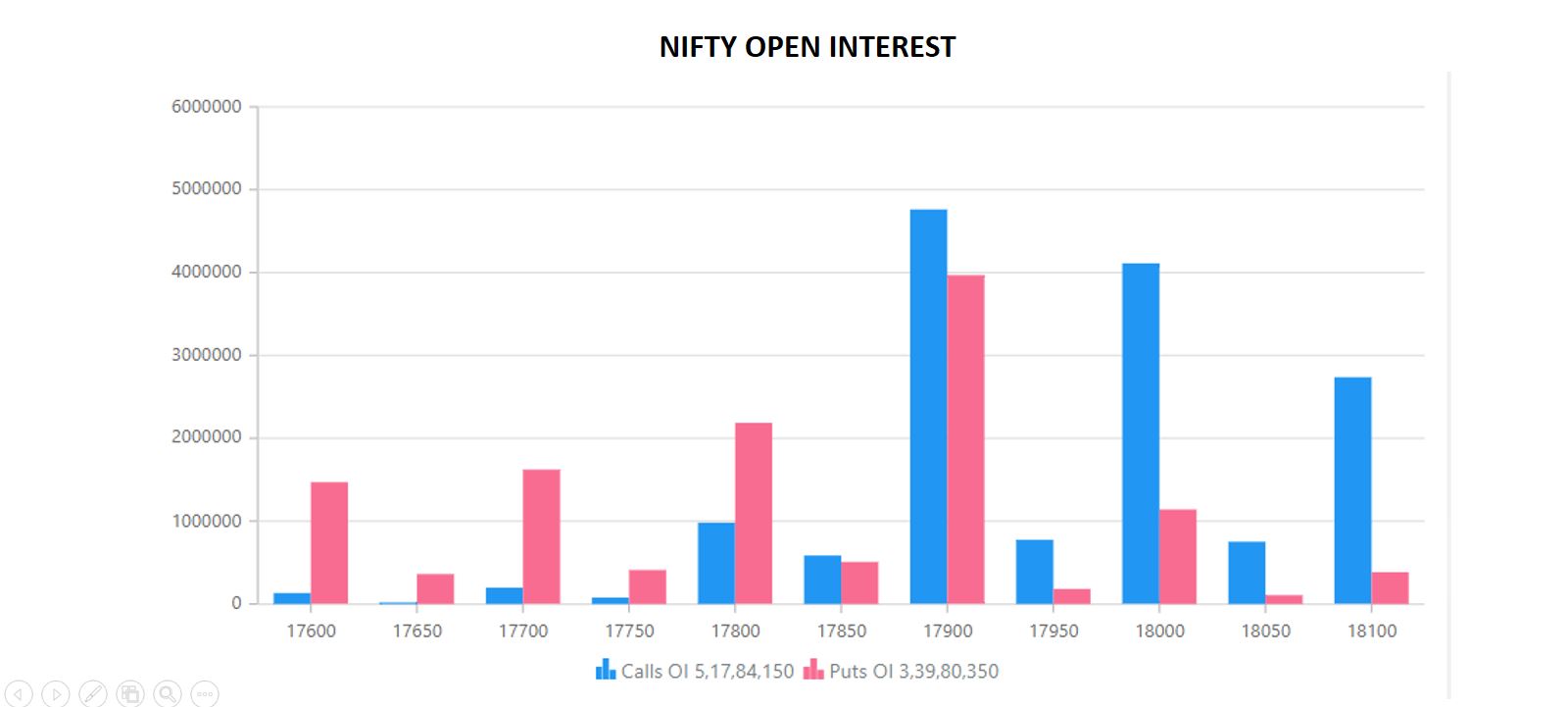

A large number of calls were built at 17900 levels subsequently 18000, 18100, 18300 levels were also seen with high call writing along with the same number of puts were written as the highest put strike was seen at 17800 levels bringing the markets to a standstill.

A lot of Call OI was seen building in 18000 levels which happened to be as the key resistance level while a lot of long unwinding was seen from which the market saw turmoil. Yet, the level of 17600 -17900 remains a decisive zone where one has to have patience for the nifty to decide who would be the winner.

A large number of traders were seen converting their positions on the short side today at the level of 18000, as more positions were built at the 17900, 18000 and 18100 levels making it evident for the nifty to have a downside fall.

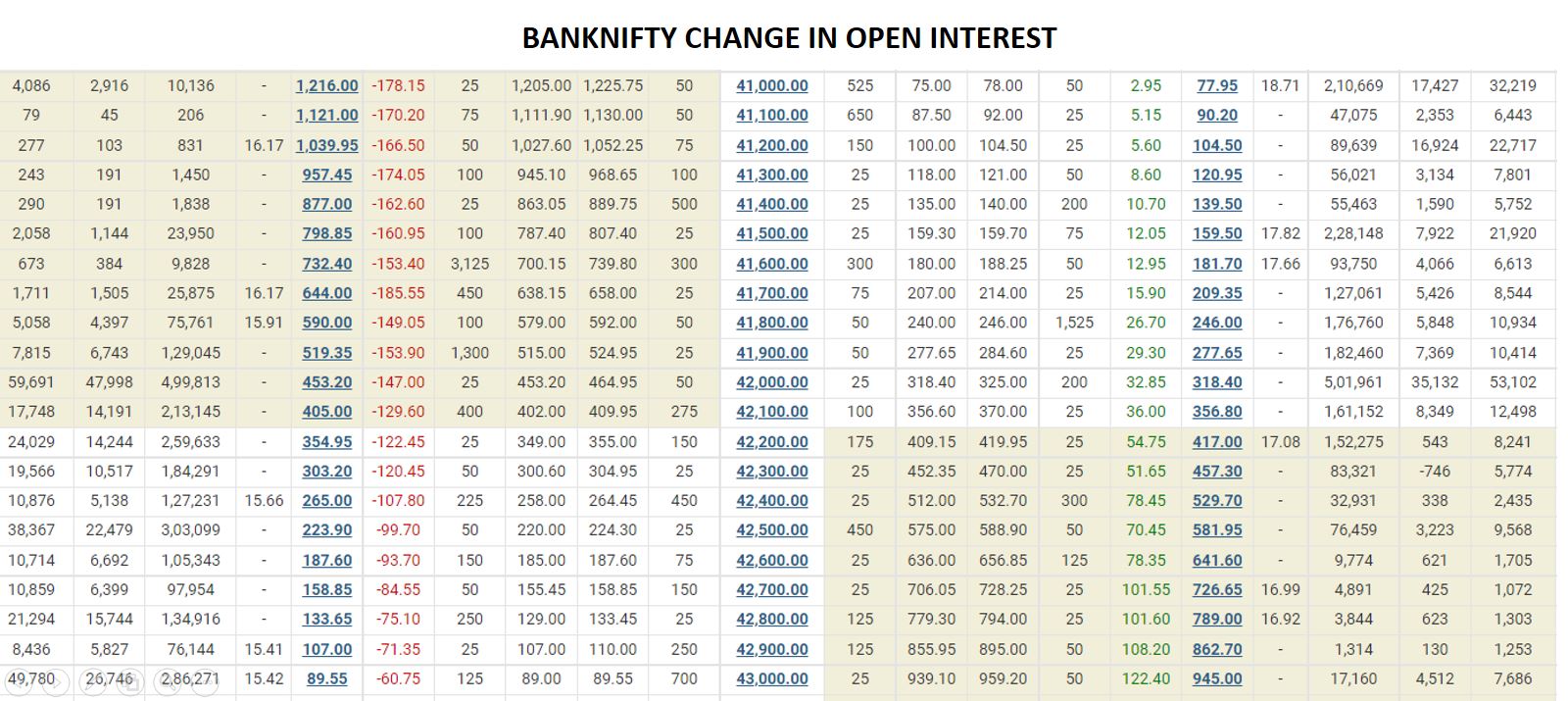

The top 4 stocks of Bank Nifty around 70 % by weight has undergone considerable weakness indicating that the trends are pressured to the downside

The performance of these top 4 need to improve to once again reinstate some bullishness till then we should be looking at every rally for a sell opportunity.

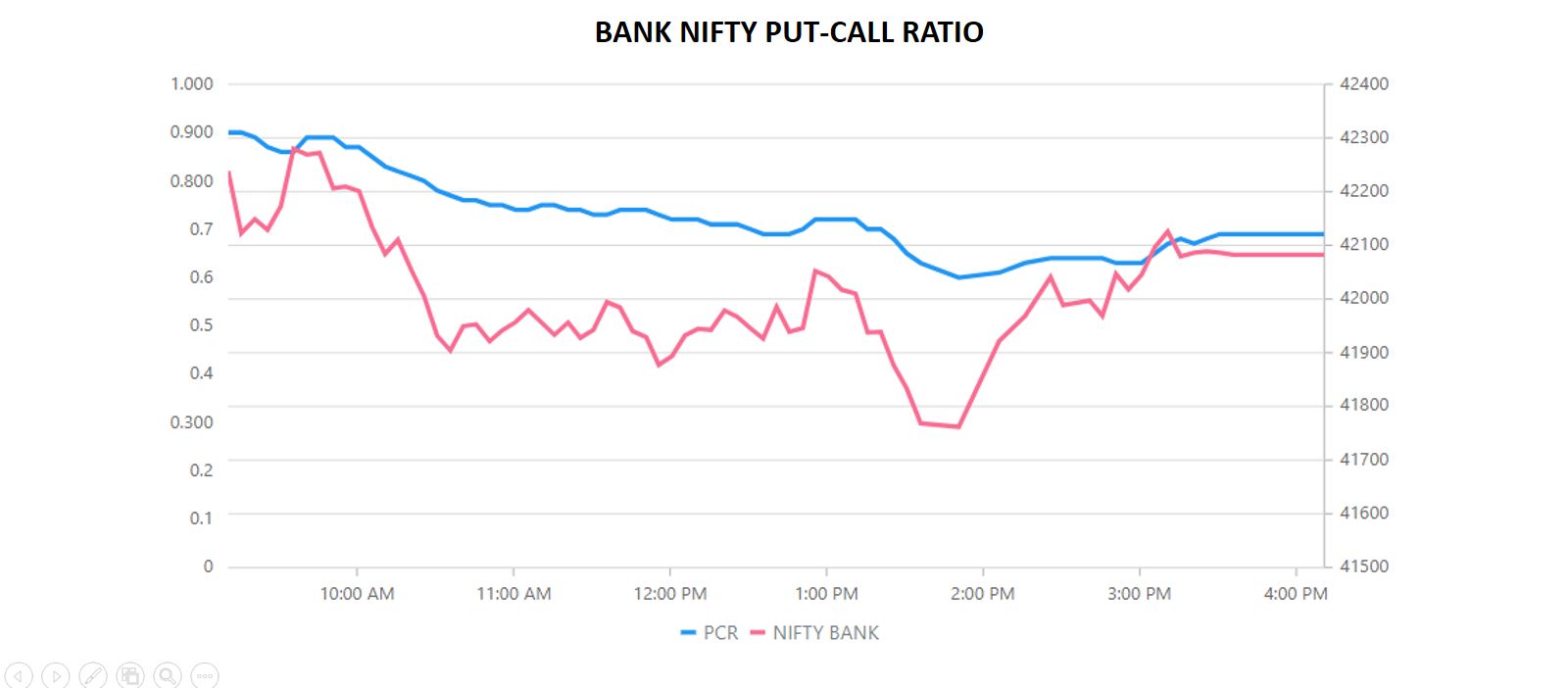

However, the PCR suggests that we have reached an oversold status and is hinting at the indices displaying a rebound.

A steady decline was seen in the put call ratio as the markets trimmed we saw equal number of buyers to sellers now as the markets coming below its 0.6 oversold pcr. The decline continues to indicate that the trends are bearish.

Call shorting in Bank Nifty too has reached an extreme and is showing potential for a rebound.