Not much of bearishness through the week as the traders tried to make some sense out of the extreme volatility.

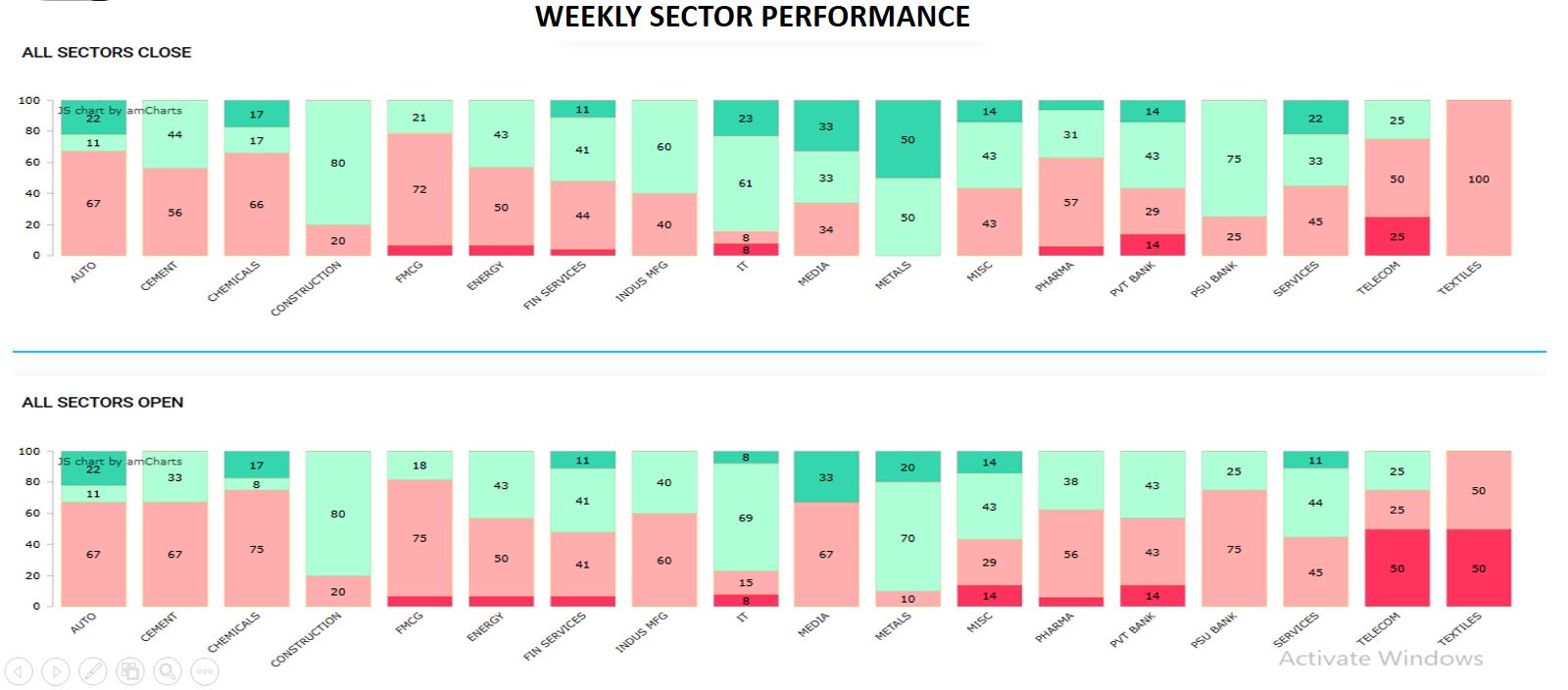

Majority of the Nifty stocks showed limited moves indicating that no one was clear with the market action.

Positive moves seen in IT sector could influence some moves , however too much reliance on IT will not help as market never obliges to what we expect.

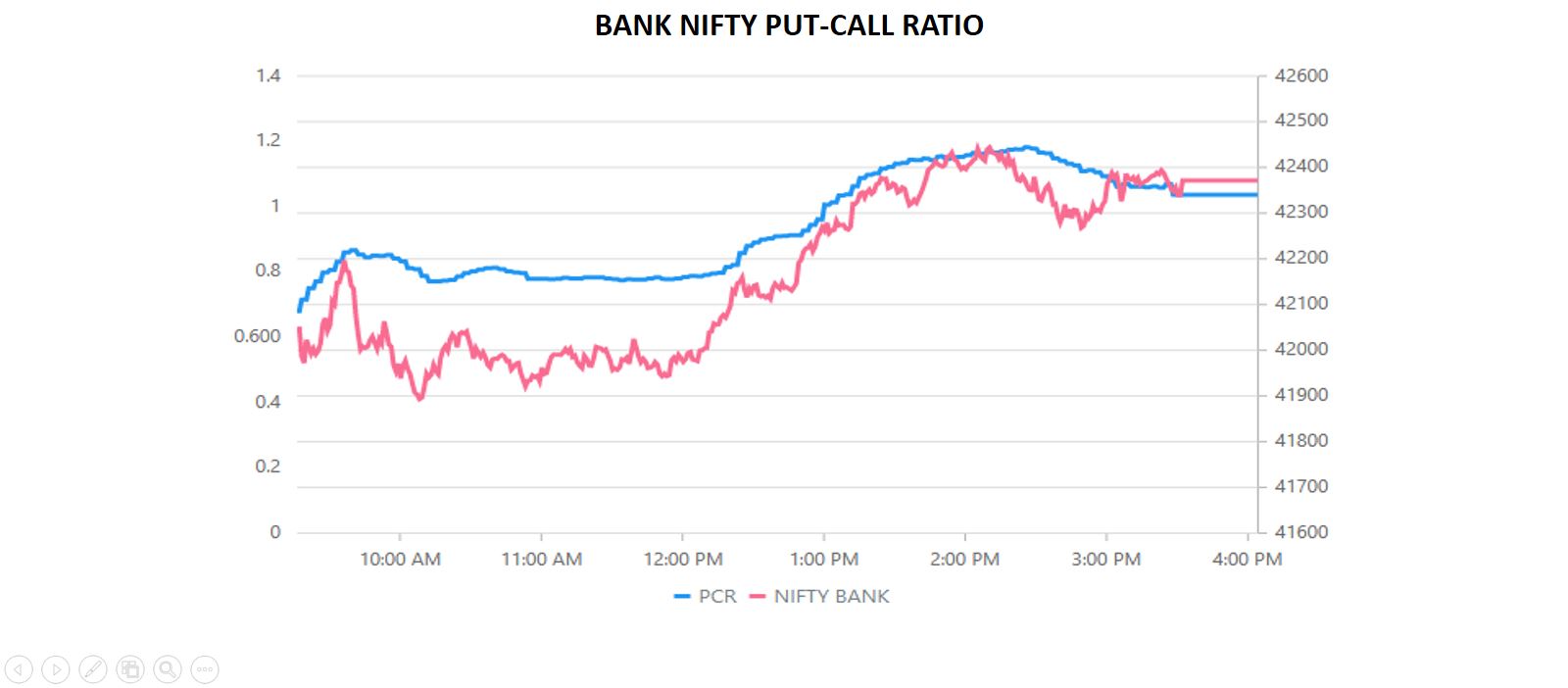

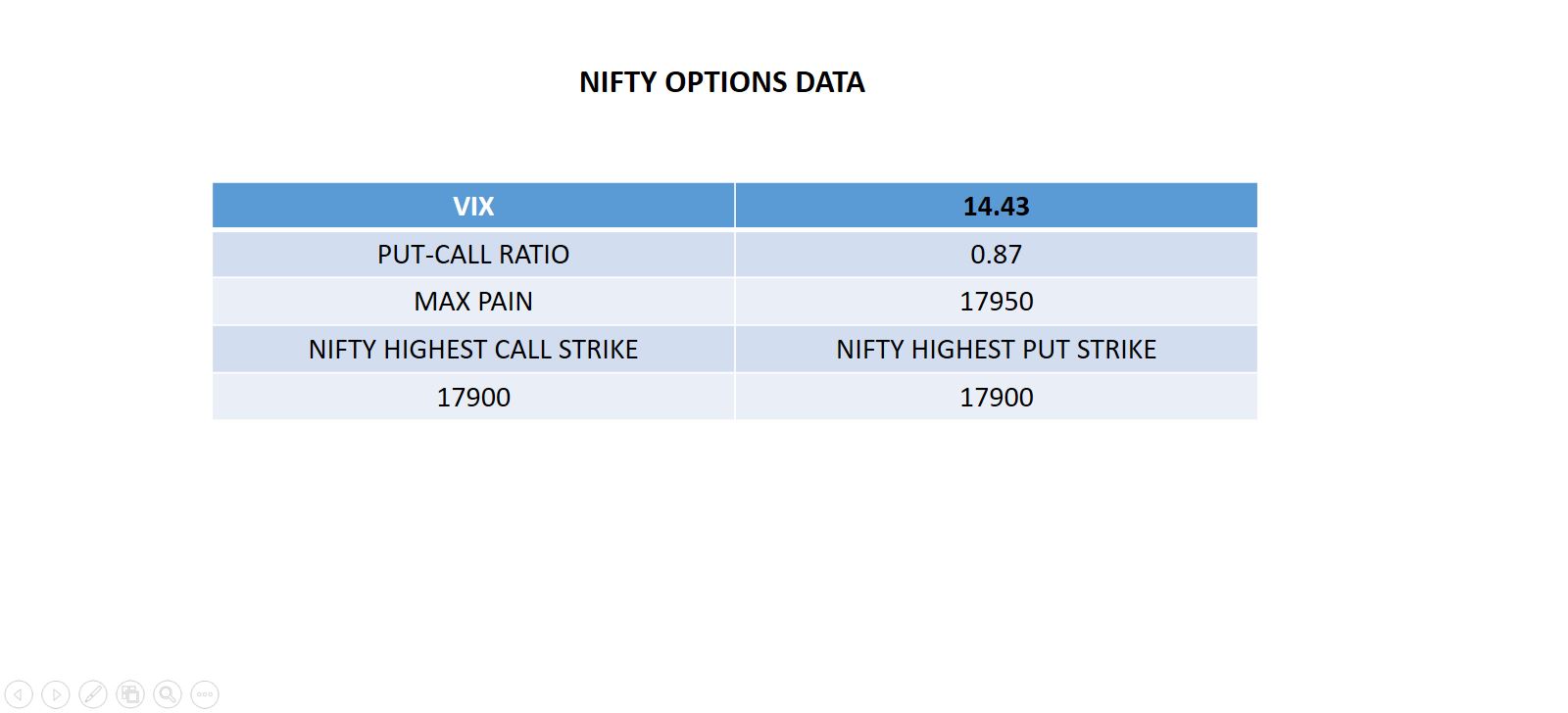

However, the PCR suggests that we have reached an oversold status and is hinting at the indices displaying a rebound.

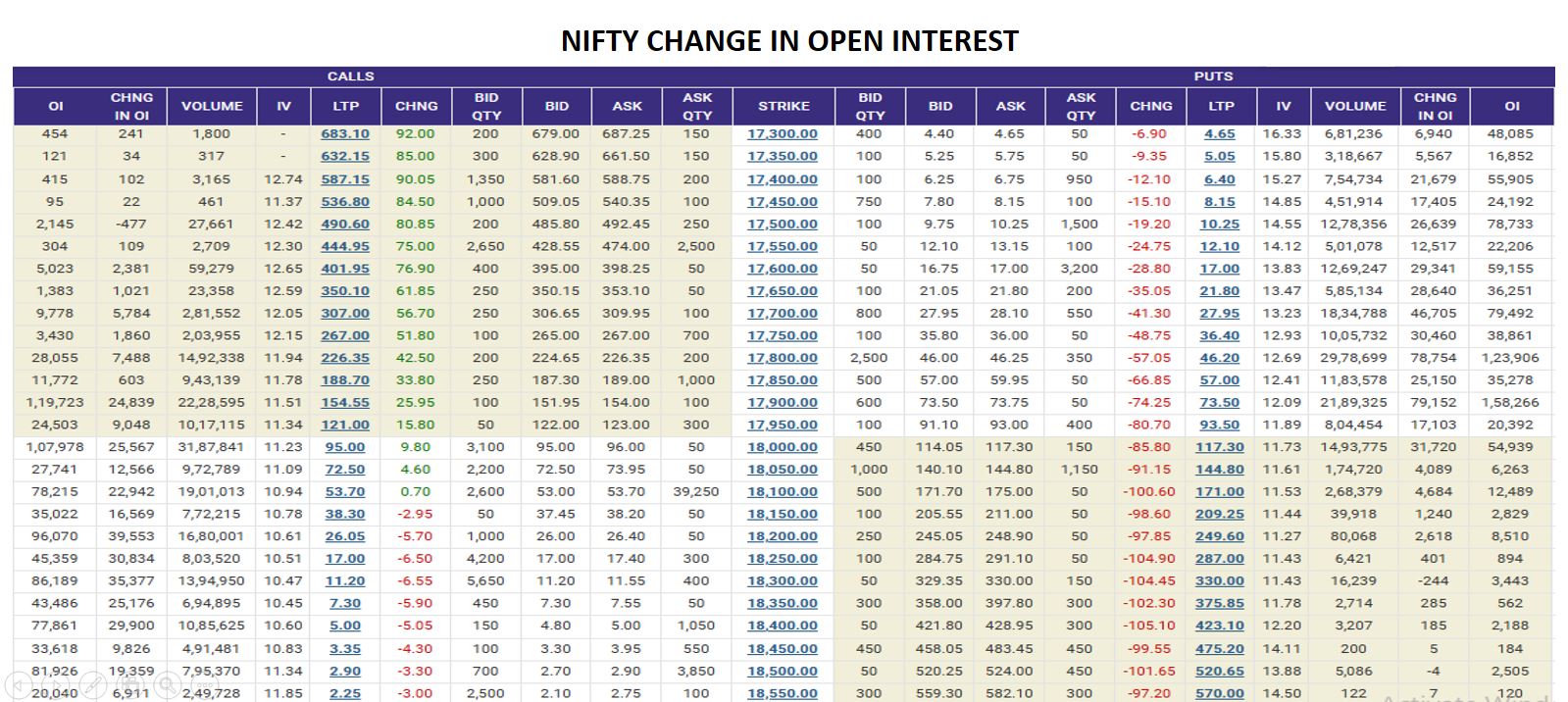

Steady Put writing at lower levels indicates that the trends could emerge towards the upside. As lower levels are now being defended we can expect an attempt to move higher or slip into a range-bound scenario.

A steady rise was seen in the put call ratio as the markets showed some eagerness as the PCR climbed towards 1. Yet the bearish pressure at higher levels shall keep the sellers in the fray.

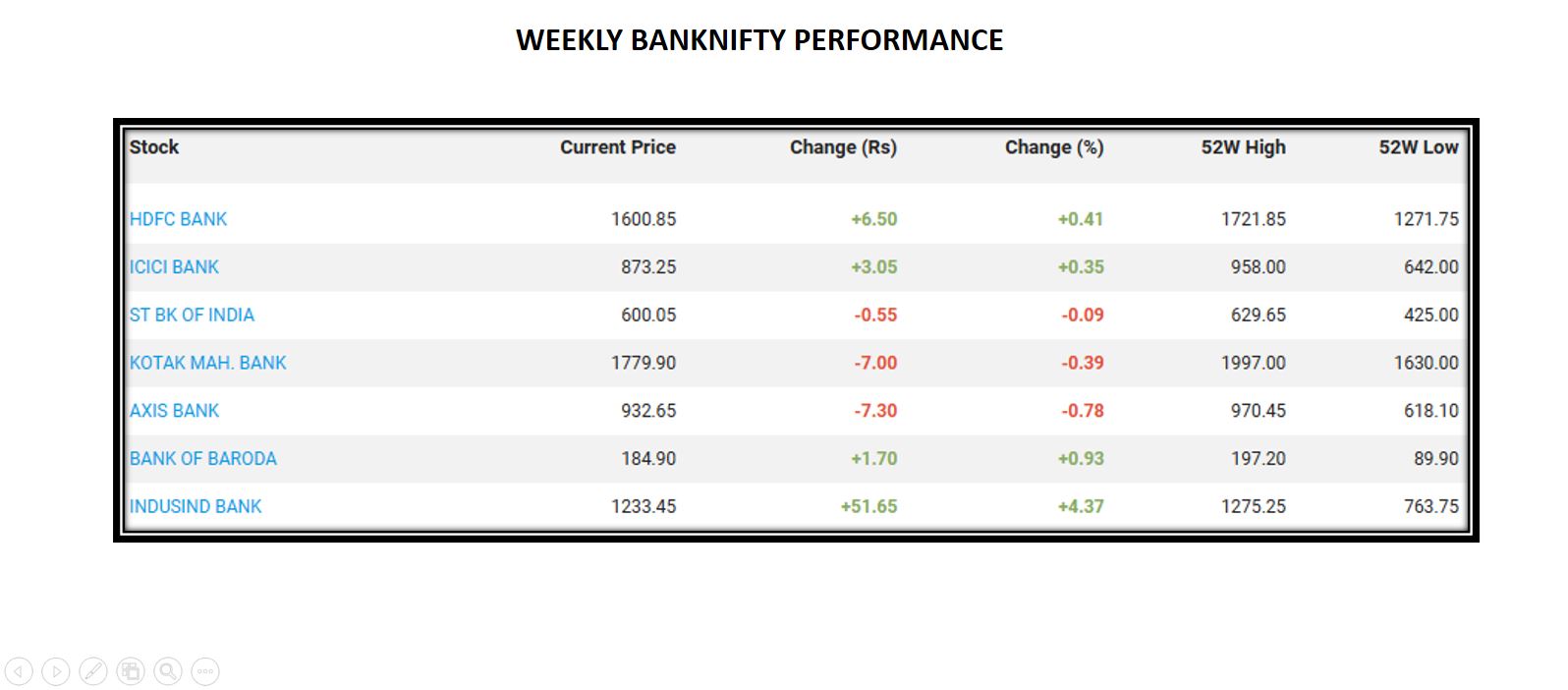

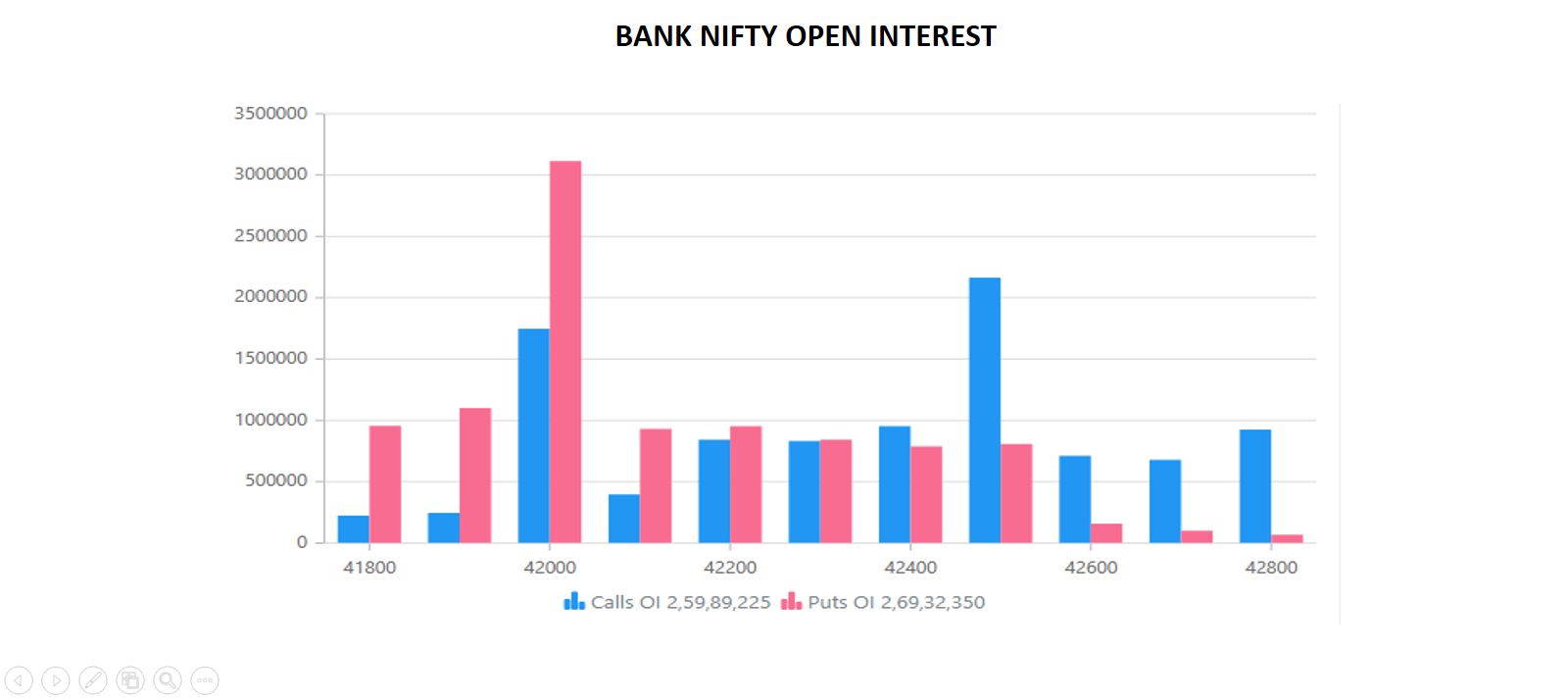

Neutral opening was seen today following the opening range. As the momentum shifted banks seemed to tumble down as over nifty trimmed consequently, brining the price to its long term support. Overall a green day for Banknifty to following by testing a strong support at 41900 level giving an inverted V shaped recover ending near to a percent increase.

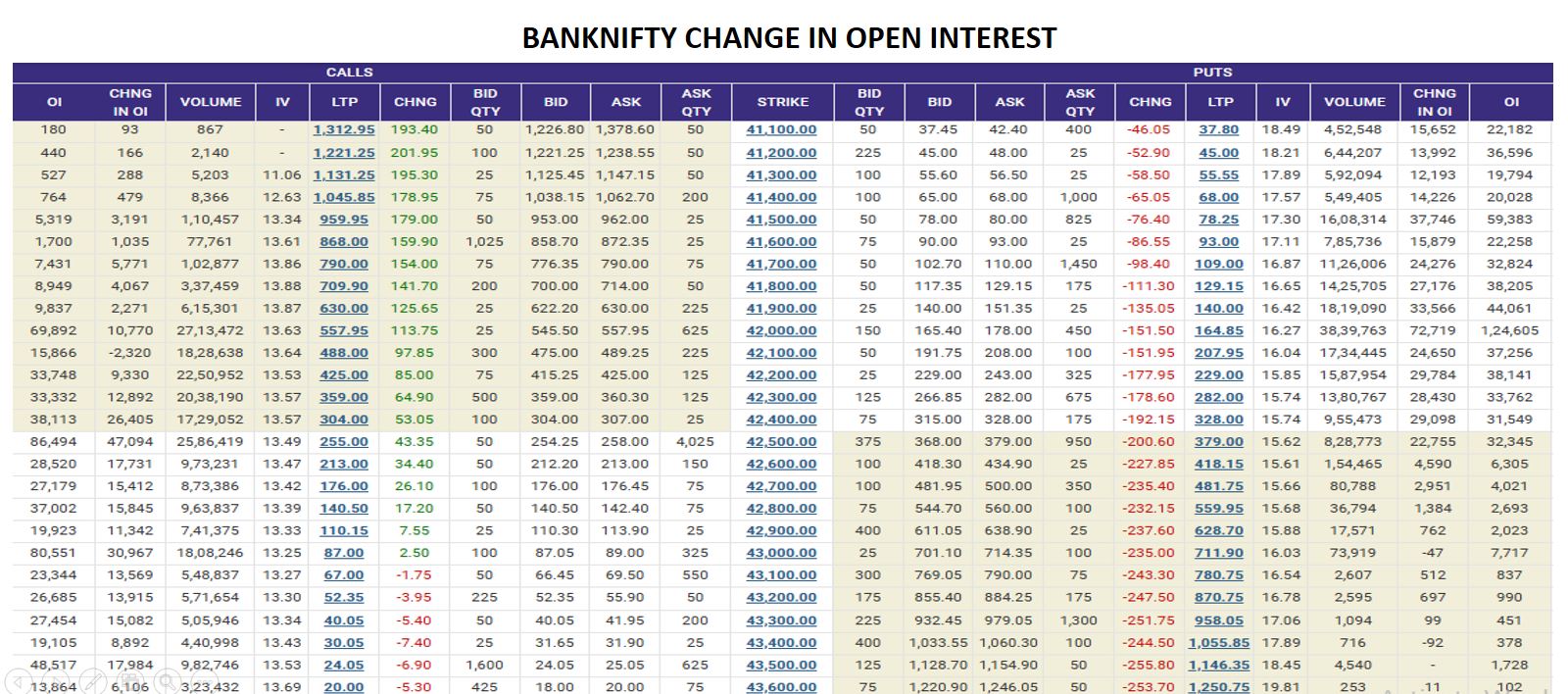

A huge number of puts were added at 42000 level depicting the market being in a complete conjection. 42000 would be acting as the strongest support zone giving the sellers a hard time penetrating this level.

At the moment call writing at 42500 levels shall play a key resistance as strong buying on rally shall be witnessed throughout. Going into the week ahead this level would be important for the bullishness to revive.

With PCR crossing 1 possibility of a further upward rise to continue is very much on the cards. One can use the first 30 min of the day as a range to track and then participate.