Sugar industry in India is the second largest agro-based industry and it contributes significantly to the socio economic development of the nation. Indian sugar industry is also a major sector to employ 7.5 per cent of Indians.

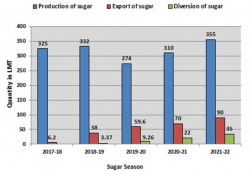

India has been a leading producer of sugar in the world and also the second-largest exporter. The recent statistics states that the sugar output achieved so far is much higher than the total output of the entire year of 2020-21. We have already generated 15 per cent of a record 35.24 million tonne till May 30 in the on-going 2021-22 marketing year on higher output in Maharashtra and Karnataka.

However, as suggested by the NITI Aayog, exports are not the best solution for the sugar industry. The second part of the solution to address the problem of excess sugar is to divert excess sugarcane to ethanol. This part of the solution is immune to global situations, will boost the agricultural economy and will reduce dependence on imported fossil fuel. It also helps reduce the air pollution. Government has fixed a target of 10% blending of fuel grade ethanol with petrol by 2022 & 20% blending by 2025-26.

While India’s export surplus is not much considering that it consumes most of the sugar it produces, the outflow of the additional output would have mollified the market. Given the acreage in which sugarcane is grown in India, the surplus would have been higher for the low sugar recovery, that is yield from the cane. Australia, for instance, has the highest recovery at 14.04 per cent, with Brazil second at 13.81 per cent. Recovery rates were in the low digits in the past decade, but recovery has improved in India in recent years, with the figure touching 10.86 per cent across the producer-states.

The Government of India and the Oil Marketing Companies (OMCs) are aggressively promoting blending of 10 % ethanol in petrol. Supply of ethanol to OMCs was only 38 crore litres with blending levels of only 1.53 % in ethanol supply year 2013-14. Production of fuel grade ethanol and its supply to OMCs has increased by 8 times from 2013-14 to 2020-21. In ethanol supply year (ESY) 2020-21 (December – November), about 302.30 crore litres of ethanol has been supplied to OMCs thereby, achieving 8.1% blending levels.

As envisaged by Prime Minister Modi , India has now achieved 10 per cent ethanol blending ethanol blending in petrol, 5 months ahead of the November 2022 target. This activity has significant widespread advantages. Firstly, it has resulted in the reduction of 27 lakh tonnes of carbon emissions, secondly, India has managed to save over ₹ 41,000 crore over an eight-year period, and finally, the farmers of the country have earned more than ₹ 40,000 crore, during the last 8 years.

Let’s take a look at 3 most promising setups that we are witnessing in the sugar sector.

Praj Industries

Exhibit 1

Exhibit 2

The relative strength comparison seen on the charts reveal that the trends in this counter have been underperforming. On a higher timeframe we note that the trends are clearly not interested to move higher and the pressure is to the downside.

In Exhibit 1 we can note that the NeoTrader Dialers are pointing to a much muted response that is being displayed as the trends are clearly under pressure. At present the momentum continues to favour the downside and the prices remain pressured. The trends from a medium term perspective is holding on to the recent gains and will need some reinforcements to stage a revival.

Renuka Sugar

Exhibit 1

Exhibit 2

This counter is doing reasonably well and is sustaining the momentum that has helped it much better than its peers. Considering its revival after the profit booking witnessed earlier this year the counter seems to be well placed for an up move. On a higher timeframe we note that the trends are clearly bullish and could encash the favourable tailwinds.

In Exhibit 1 we can note that the NeoTrader Dialers are pointing to a bullish response that is being displayed as the trends are clearly witnessing steady buying interest. With news flow and price action favouring an upside , one should participate in this counter. The trends are encouraging from a short term and medium term perspective. Based on the pivot structure we note that the prices are on the threshold of some trended action.

Balrampur Chini

Exhibit 1

Exhibit 2

After jumping by nearly 60% in this year the counter witnessed a massive sell off – largely a combination of profit booking and bearish bias that got built. We find that despite the strong reaction the counter has managed to hold above important value area around 380 and rebound positively.

In Exhibit 1 we are observing that the NeoTrader Dialers are pointing to a much muted response that is being displayed as the trends are clearly under pressure. At present the momentum continues to favour the downside and the prices remain pressured. Currently the trends are confused and are attempting to consolidate before they stage a revival.

Conclusion :

Positive newsflow continues to emanate and will keep this sector active in the coming days. RENUKA looks to be the best bet at the moment and should be considered for some trades from an investment or trading perspective.