IT stocks were the darling of investors in the post covid era but in off late we have seen two bouts of selling which has knocked down many IT stocks across the counter. The IT counter was actively traded by most market Players and especially the new lot of retail traders who have entered the market. Large investment positions have also been built in this stock across the past two years. In this note, my focus is going to be towards all of those who are looking to trade the IT index from a short tem perspective, and what you can do in this sector going forward across the next few weeks.

The larger picture

Firstly, Let us look at the price action that has ensued, the index gave a near vertical move from the lows of Mar20, faced some consolidation in Sep oct 21 while the broader market corrected, it sustained and progressed further to make a high of 39447 in Jan 2022.

Post the January high we saw two bouts of correction, the first one was short and showed a recover in march, signaling that the worst was over and sucked many new traders, the second round that ensued in Apr 22 was painful as it was a near vertical fall and the old guys who refused to sell , the ones who averaged in march thinking it was only a pause in the uptrend and maybe those BUY on dips types who infused fresh money into the sector all faced a big sucker punch by the market.

How far will it fall?

Well pretty much most positional traders are stuck with their positions hoping for a recovery, question to ask is how much more can the IT sector fall?

Most fundamental pundits are commenting stating that rising inflation in the USA, signals of low corporate profitability and damaged sentiment in the market is what is pulling the sector down. There is has been a significant rise in the wage bill of most IT majors which is impacting EBITDA margins.

The reasons are many but as a technical trader I shall rely on my charts.

So let’s look at a higher time frame weekly chart , the first thing that immediately stands out is that the IT index has gone and halted at the 38.2% retracement of its larger rise, this is marked with a lower shadow and follow up green candle indicating that the level is holding strong as a support. If breached the next level on the horizon is 25,247 which will be the 50% retracement. On the upside there is resistance around 32700 , which also coincides with the downward sloping moving average line , so the index may oscillate within this range for now.

What Stocks have been the winners and losers?

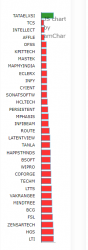

Given below as a chart that I have pulled out from NeoTrader’s sector view page, it displays the performance of stocks from the beginning of 2022 and includes all the IT stocks from the broader NSE500 universe.

Source – https://neotrader.in/

It shows the baring Tata Elxsi, the entire IT sector has been down. Only one stock that is showing a positive results and the rest are losers.

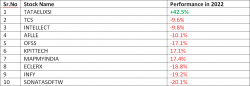

Looking closer I have tried to pull out the stocks that fallen the least in this decline, so naturally the stock that corrects the least in a decline tends to perform the best and recover the fastest when the sector turns, it will bide traders well to keep this in your radar.

Source – https://neotrader.in/

Strategy going forward

Although we do not have any clear sign of bullishness, we can start positioning ourselves for the future. If you are investor, you can look to accumulate the above 10 stocks in phased manner as and when things start to improve and market sentiments look up.

As a trader, These 10 stocks should be in your watch list, and look for smaller multiday moves in these stocks every time they hit a support point.

If you are using a software like neotrader.in, what you can do is look for some reversal signals which come on the readymade multiday and positional trade pages.

For those who are playing both sides, you can also keep an eye on the bottom rung of performers in this list and look for short technical signals(intraday and multiday) in these names as they will be susceptible to future downside if the selloff in the sector continues.

It’s imperative that we be prepared for all circumstances and keep some powder dry as and when any opportunity arises.