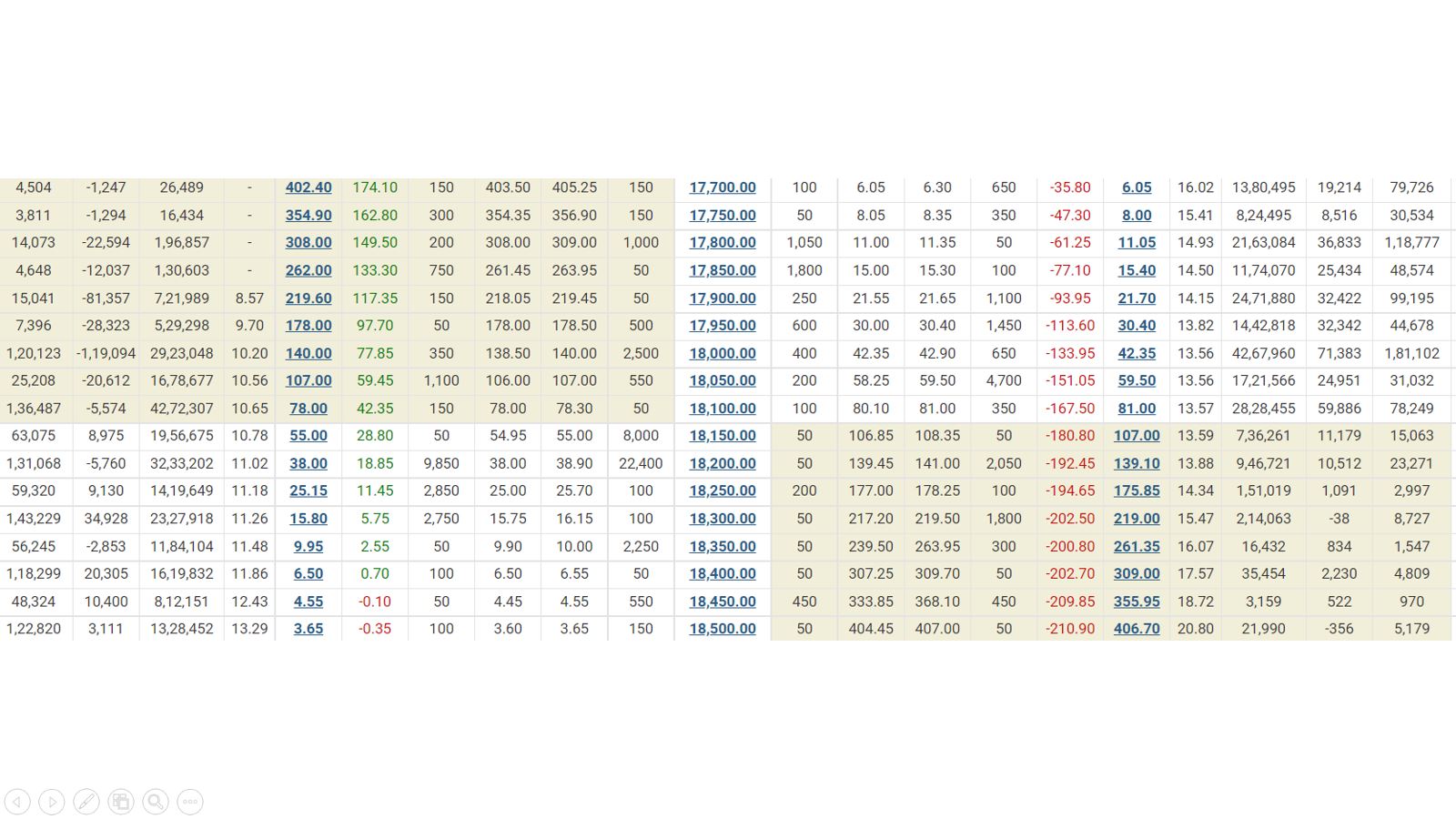

Markets moved higher as anticipated and rose towards important cluster region around 18130 (Nifty Spot) . The overhang of selling pressure continues to remain which caused the prices to correct as the profit booking by intraday players. The test of Friday’s high is suggesting that the Nifty is showing some willingness to move higher. The levels around 18100 will assume importance as we head into the day.

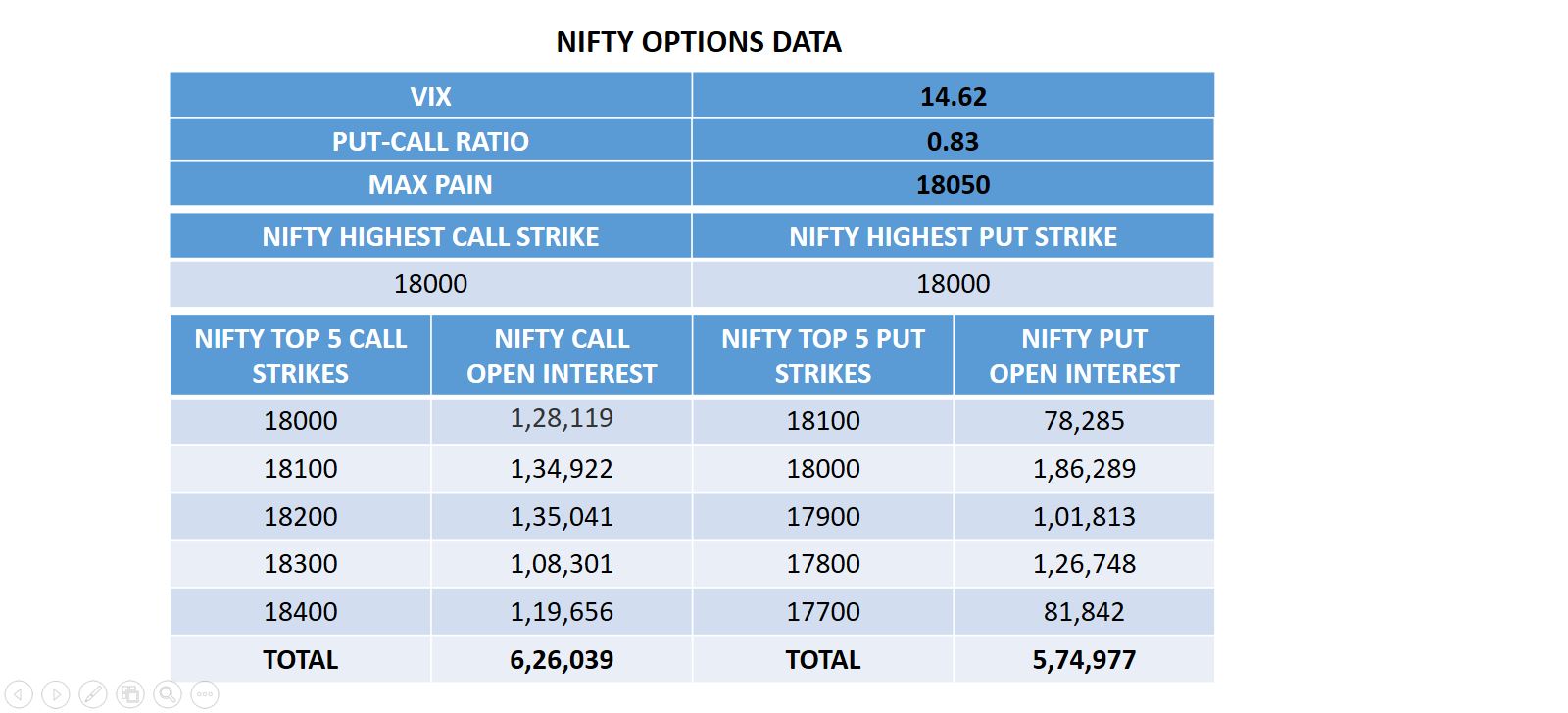

Strong Put writing at 18000 level suggests that this level could be the inflexion point. The Max Pain is now once again moved to 18050 from 18000 and the shift is quick due to the extreme volatility that we are witnessing.

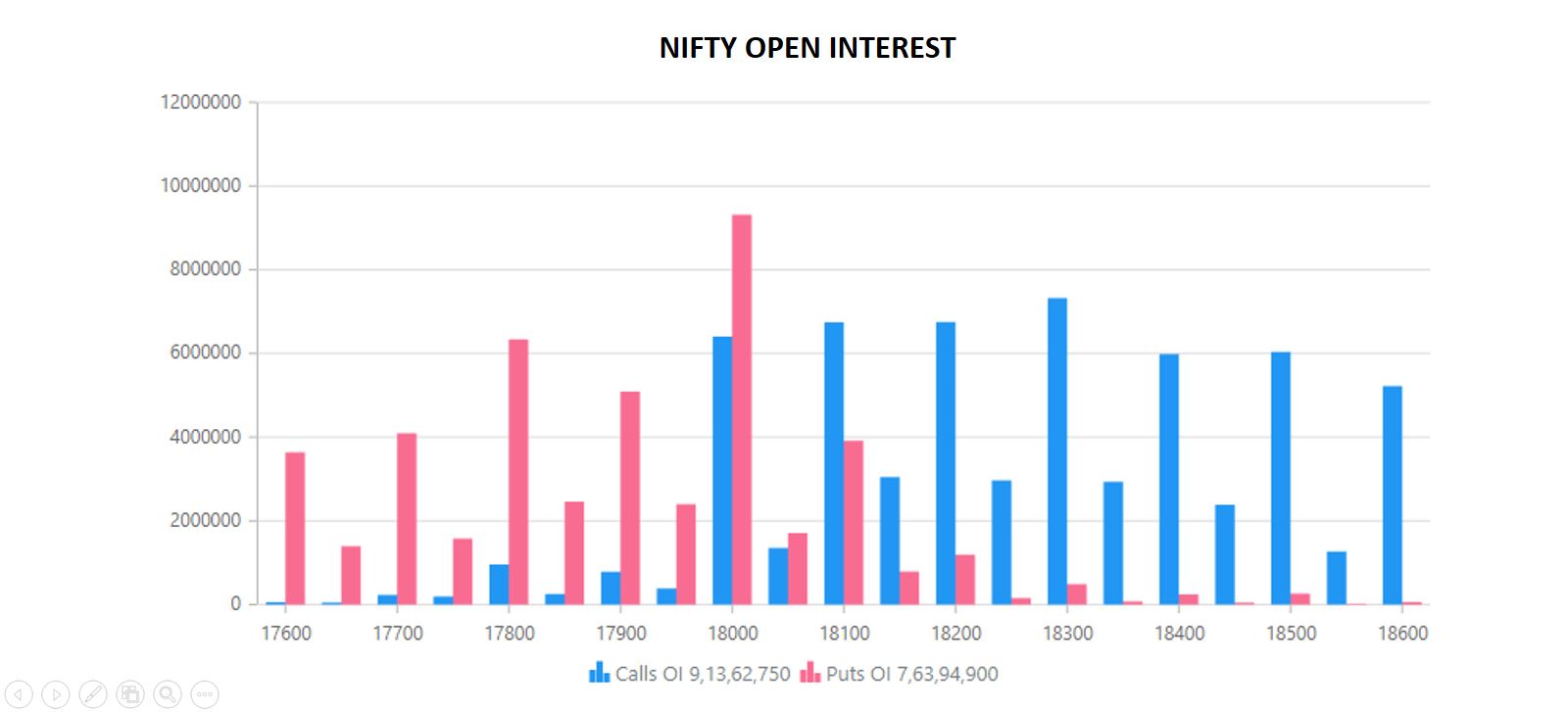

OPEN INTEREST:- There is now an even buildup in Put and Call OI was seen building in 18000 levels which happened to be as the key support level while a lot of long unwinding was seen from which the market saw a turmoil.

Looking at the recent strikes we are able to conclude that there is not much Call writing happening while the action has shifted to Put writing building a good base for the moment.

As an approach we should wait for a breach of the first 30-minute range to the downside would spell more room to the downside.

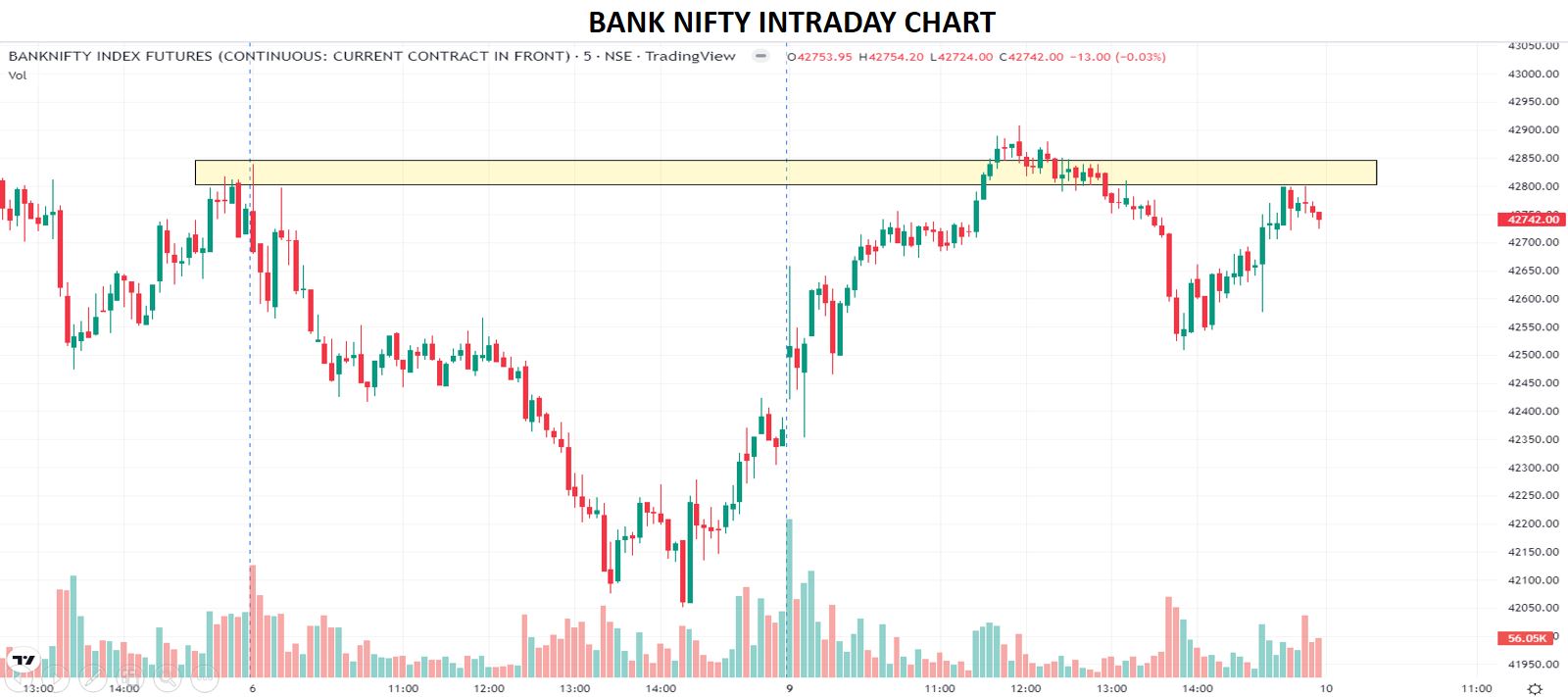

Bank Nifty could not generate enough momentum to the upside and it quickly gave up the bullish momentum as domestic markets started reacting to the rate hike by US Fed Reserve. The Indian markets started panicking in advance and the otherwise resolute Bank Nifty soon gave up the gains.

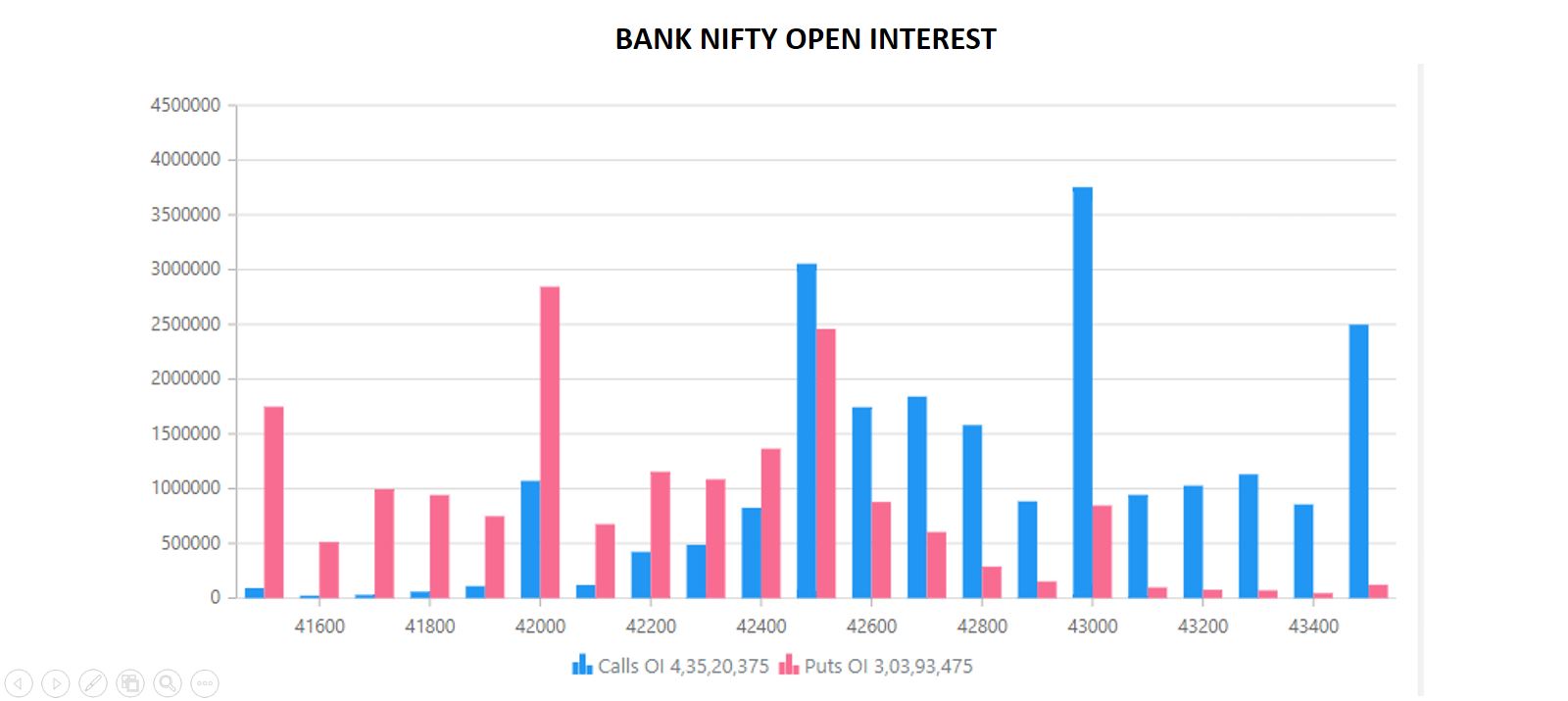

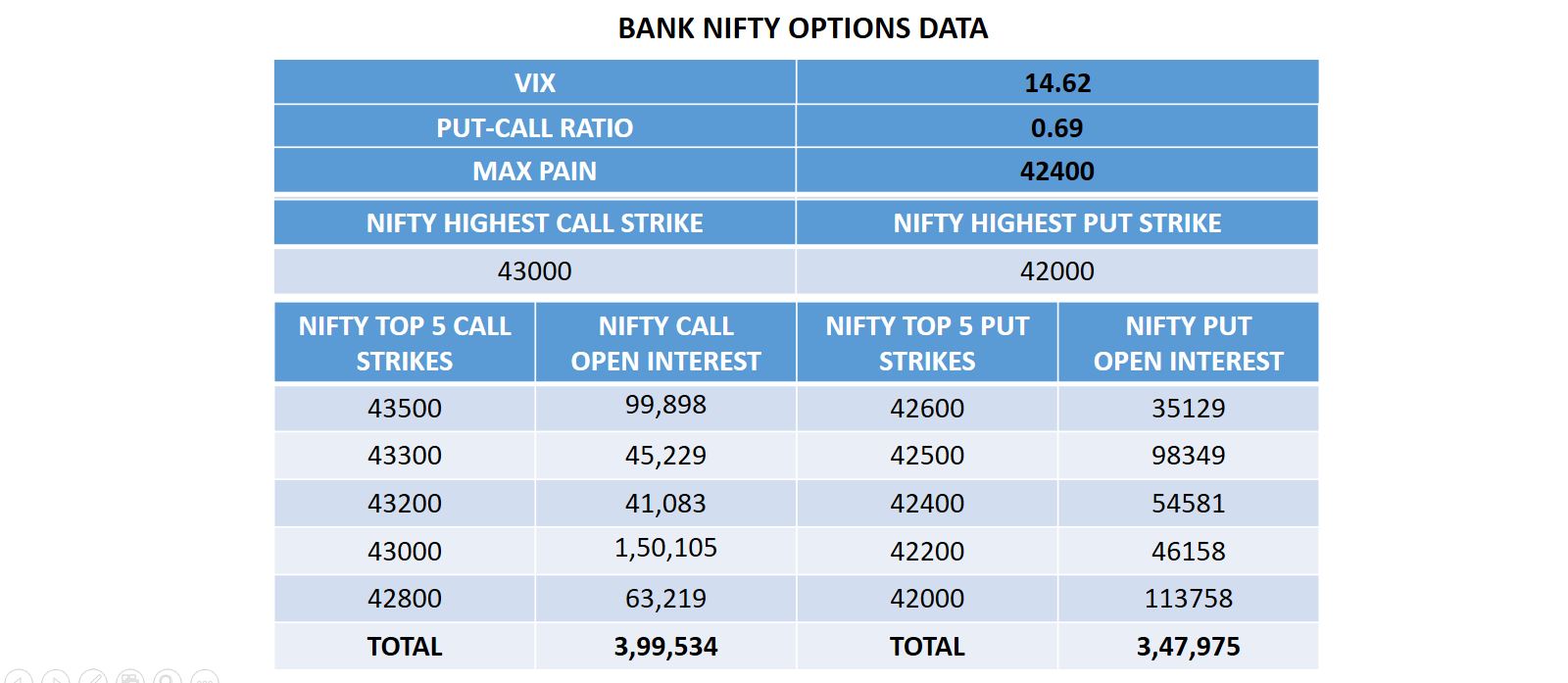

OPEN INTEREST:- A huge number of Put writing were added at 42000 level depicting the market is witnessing a shift. 43000 would be acting as the strongest resistance zone giving the buyers a hard time to penetrate this level.

Put writing at 42000 levels shall also play a key support as strong selling on rally is being witnessed throughout. Going into the week ahead this level would be important for the bullishness to revive.

Based on the recent active strikes on the CE side and PE Side remains evenly balanced the lack of participation in the Bank Nifty trends does keep the trends in this index guessing.

The attempt to recover from lower levels is muted there could be a swift selling in this index if the initial move of the day does not survive. One who needs to short should look at this index first.