We are drawing to the end of the first month of the New Year and Stock Markets have been pretty volatile and a sharp 5 day sell off has definitely punched holes in the portfolios of many market players.

There is one thing that will always happen when we see a V shape fall in the Stock Market, Quick losses. Generally when there is a sudden movement it is difficult for traders to position themselves in advance and many end up getting caught in the wrong side, for e.g. last week when all the longs in the market got chopped off.

Many times as traders we are left wondering, what we could have done to avoid this.

The short answer to this is – Be Nimble!

What does this mean; we may have to take a more practical approach.

Its simple, when you are a directional trader and the market suddenly changes direction, there is little you can do about it in the start, but what you can do is manage your response.

And this can happen if you keep these 3 points in mind.

- Disciplined stop loss – Stick to the stop loss that you agreed to in the beginning of the trade and cut out your positions. Inside of NeoTrader we have ensured that every trade comes with a stop loss, respect it , this will help you exit such scenarios with minimal damage.

- Avoid Big Loss – Big loss comes from not applying stop loss to the trade, when you have big losses it becomes difficult to recoup unless you are taking very big profits as well along with it.

- Play the down side – Yes, this is most challenging for many traders , is to quickly change their view and think contra, so essentially for this we have built Augmented Artificial Intelligence through NeoTrader to read the trend and give you those trades in a ready-made fashion, now you need to follow, because at such times it becomes easy to make money and recoup any of the losses made earlier.

Let’s see how we can do this.

Now the market fall started off from 18th January. So ideally if you wanted to make money from the downside in the market you should have started shorting stocks from then.

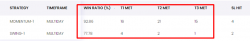

Given below is a snapshot of the multiday page of NeoTrader on 18th January.

Super Profitable barrage of Short Trades

Literally every trade that came has gone and hit the target since then, and all of them are short trades.

This flurry of trades could have easily helped any trader bag a big profit in the past few days , and more importantly help you play the downside of the market at a time when the trend is bearish. (Something very difficult to do without technology)

If you look further you will find more statistics and the evidence is even more telling.

93% of the multiday trades have been profitable

This means that you could have played this entire downtrend if you had followed NeoTrader which actually uses the principles of technical analysis and trend following.