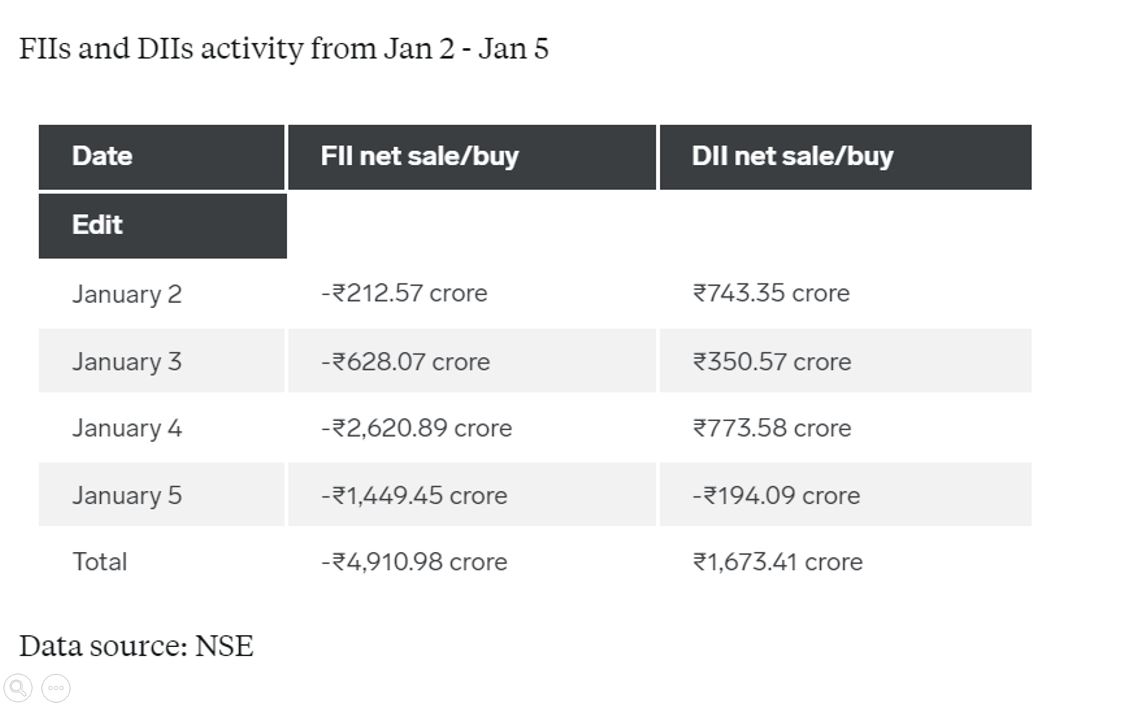

•FIIs have been selling Indian equities for ten consecutive sessions, pulling out liquidity from the market The major drag on the market now is the sustained selling by FIIs. FIIs sold for the 10th consecutive day yesterday, taking the cumulative selling to ₹11,400 crores.

•As a result, benchmark indices Nifty50 and Sensex have already dropped 2% each in the first week of the year.

•Meanwhile, domestic institutional investors have infused ₹1,673 crore in the first four sessions of the year.

•After strong buying in November, FIIs went on to sell Indian equities aggressively in December as rising cases of Covid-19 in China spread concerns over global economic growth.

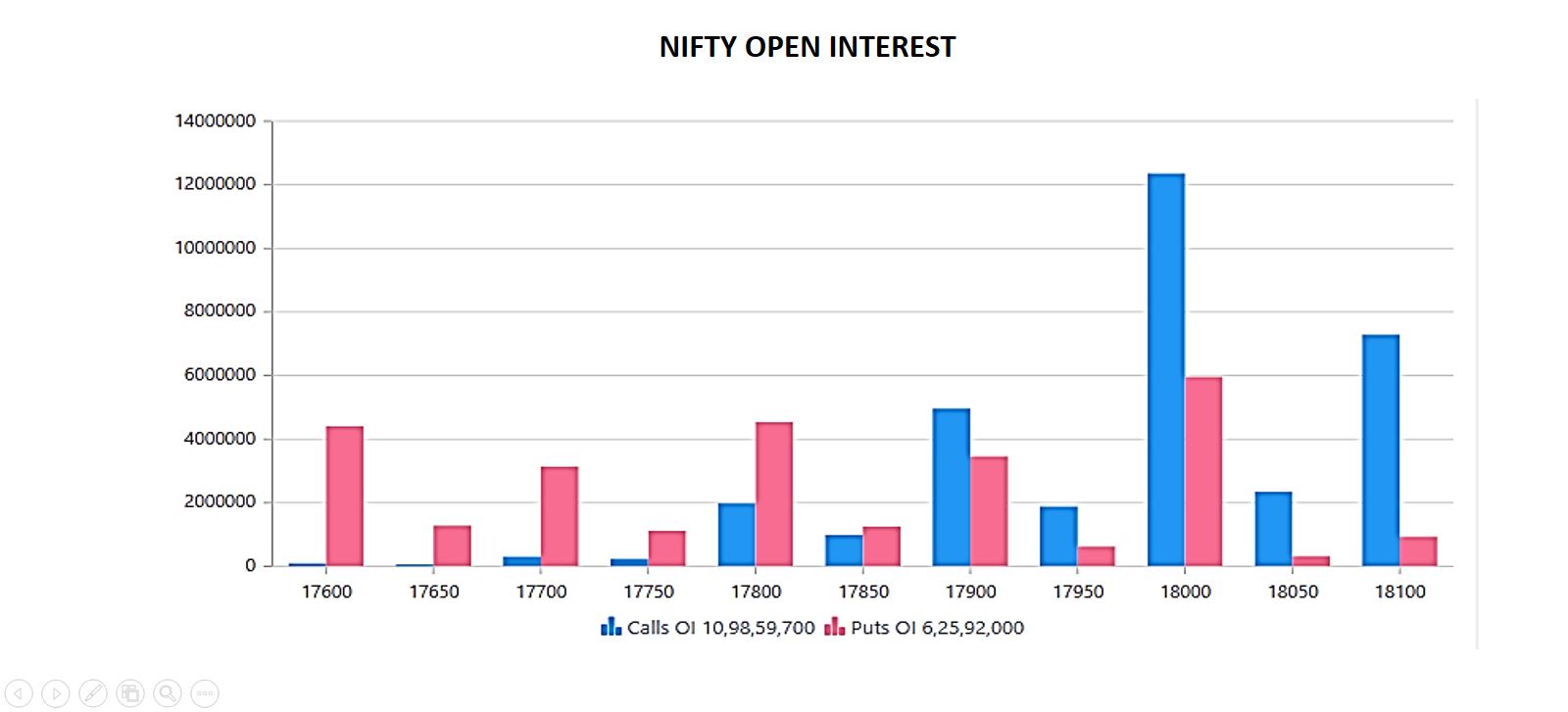

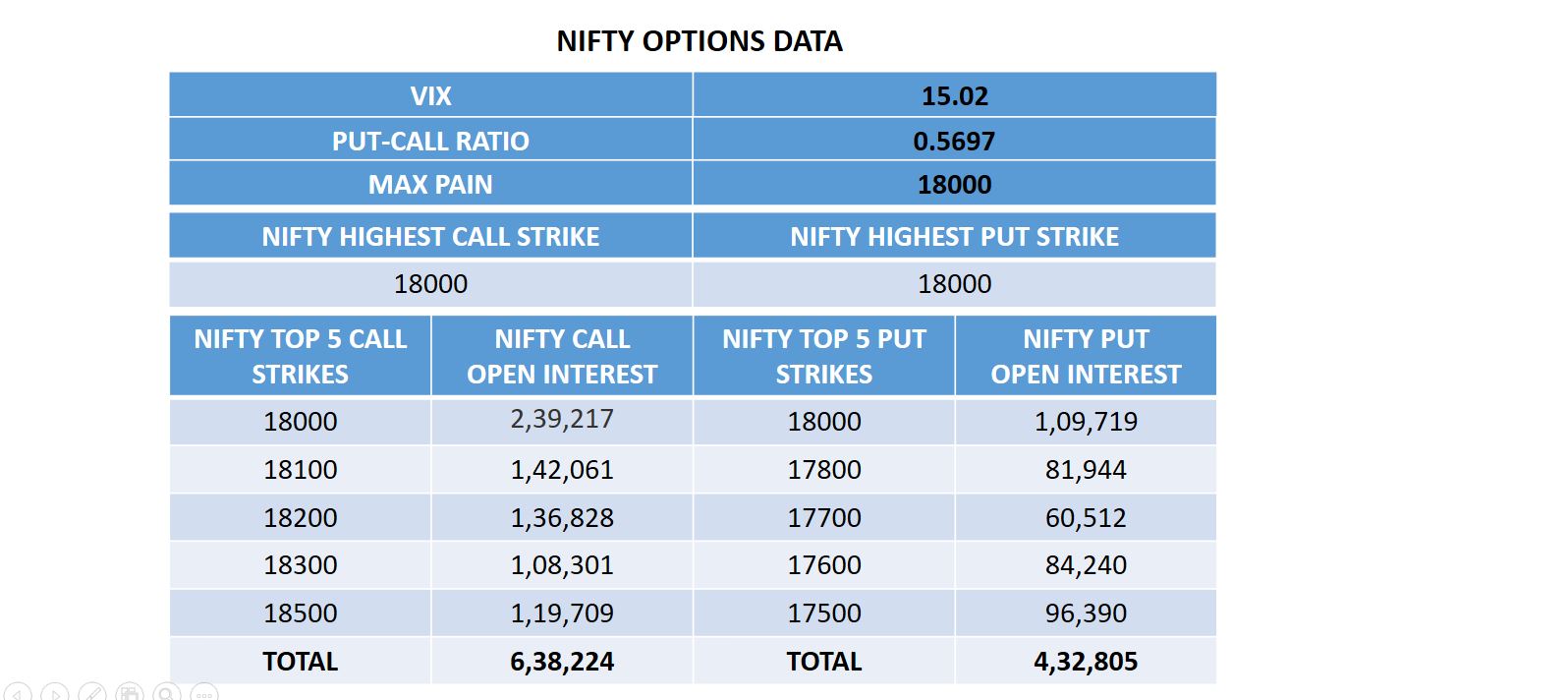

Some bullishness shown at the start of the week as Nifty attempted to rise above 18300 ,however due to the constant selling pressure at 18300 the selling pressure impacted the price action. The sustained selling pressure through the week held back any attempt at recovery to force index close below 18000.

Strong call writing at 18000 level suggests that the road ahead could be a challenging one. The Max Pain is now moved to 18000 from 18050 that was held for a while that indicates that the Sellers are in control.

OPEN INTEREST:- A lot of Call OI was seen building in 18000 levels which happened to be as the key resistance level while a lot of long unwinding was seen from which the market saw a turmoil. Yet, the level of 17600 -17900 remains a decisive zone where one has to have patience for the nifty to decide who would be the winner.

Looking at the recent strikes we are able to conclude that the Call writers are still very much in control and that a breach of the first 30 minute range to the downside would spell more room to the downside.

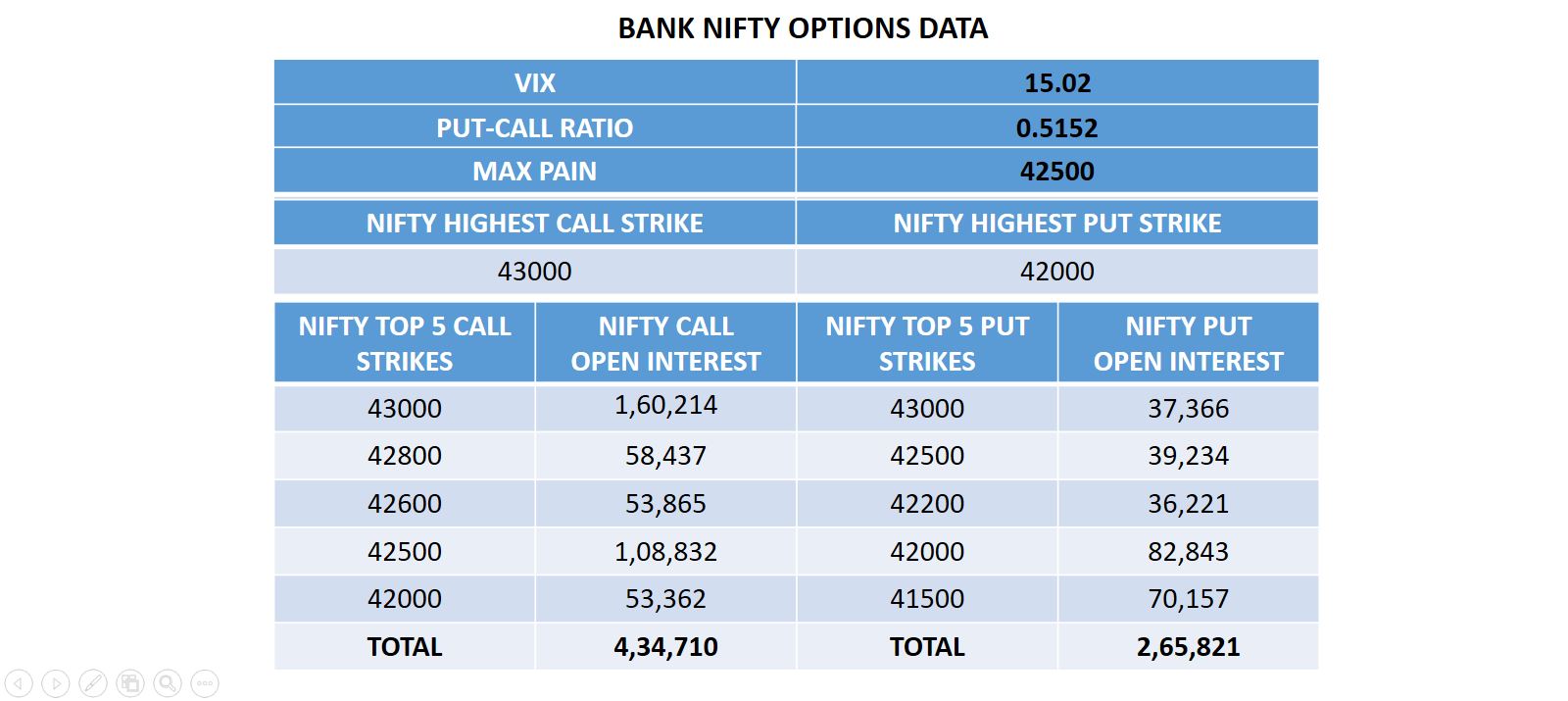

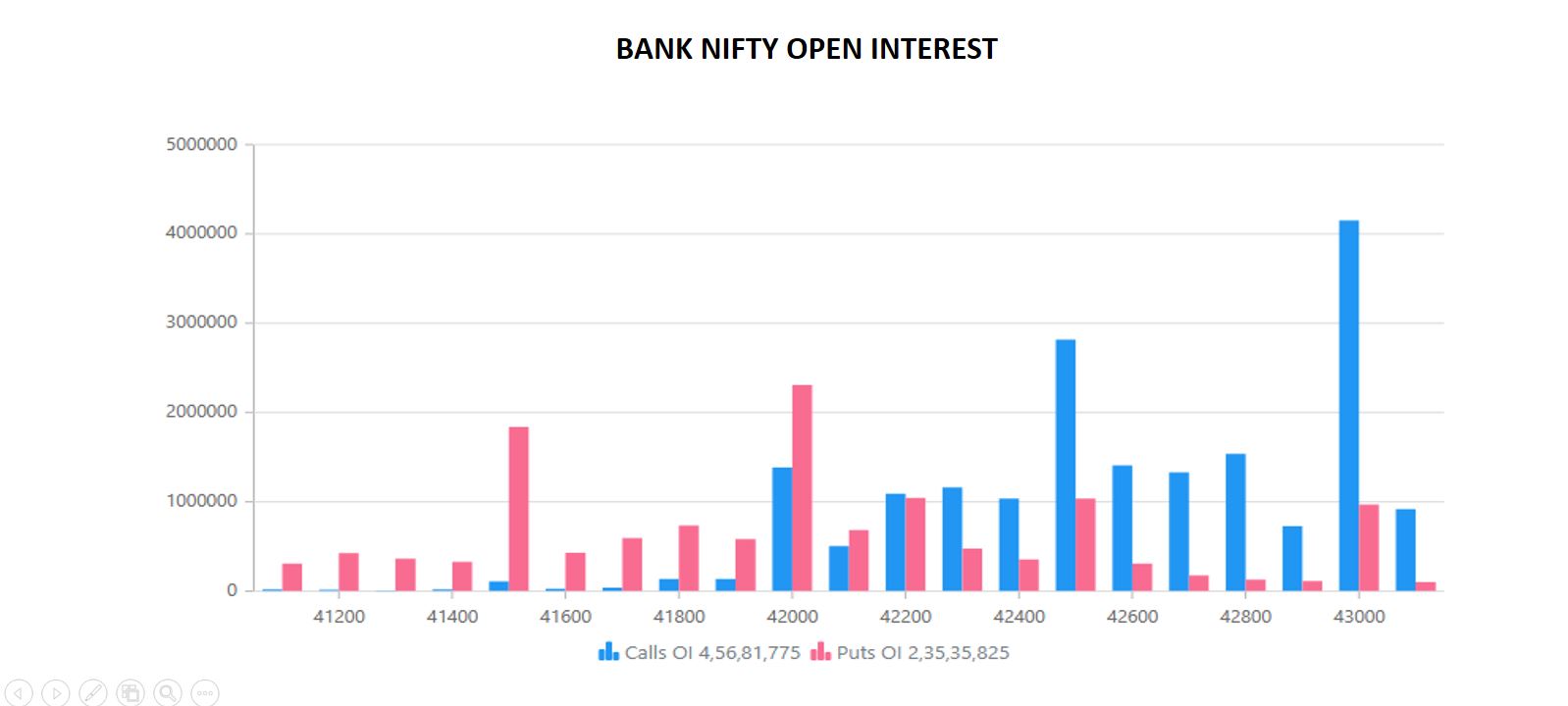

A huge number of calls were added at the 43000 level depicting the market being in complete control of the sellers. 43000 would be acting as the strongest resistance zone giving the buyers a hard time to penetrate this level.

Put writing at 42000 levels shall also play a key support as strong selling on rally rally is being witnessed throughout. Going into the week ahead this level would be important for the bullishness to revive.

Based on the recent active strikes on the CE side we note that the OI Build-up on Calls continues to be higher than the Puts thus indicating that the selling pressure is likely to be maintained as we enter the next week.

While the attempt to recover from lower levels is muted there could be a rebound based on the Dow reaction on Friday.

As mentioned we would have to see how long will the trends hold out post the market open. The key factor shall be whether the bigger hands at work are able to sustain the upward momentum. So, the first 30 minutes is very crucial as we step into the coming days.

Thanks for a marvelous posting! I actually enjoyed reading it, you could be a great author.I will make sure to bookmark your blog and

definitely will come back in the future. I want to encourage continue your great writing, have

a nice evening!