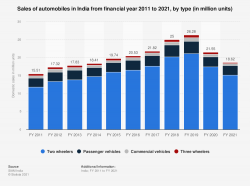

India is the world’s fifth largest market but the COVID -19 impacted the sales severely. The sales slipped to a six-year low in the year ending March 2021. Besides the pandemic which exacerbated sluggish sales, a structural slowdown, led by a slew of regulatory changes, coupled with a sputtering economy, had put auto sales in the slow lane.

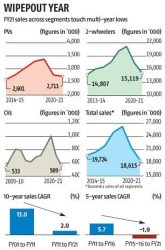

The five-year (2015-16 to 2020-21, or FY21) compound annual growth rate (CAGR) of the overall auto industry is now negative at 2 per cent, against 5.7-per cent growth it saw in the previous five years (from 2010-11 to 2015-16).

The decadal growth in the auto industry slowed from 12.8 per cent to 1.8 per cent, indicating there is a lot more to the slowdown, and that pandemic alone cannot be blamed for the multi-year lows each segment has seen in FY21.

Auto sector however managed to ride out this bad path as there were marked changes in consumer habits and behaviours. There was a growing preference for personal mobility due to the pandemic. As the shift from shared transportation increased with people prioritising social distancing and personal hygiene the sales happened.

As the Auto companies were readying for yet another tough year — the third in a row. However, amidst the recovery period and increasing material costs coupled with government policies the future looked bleak.

Come March 2022 the sector somehow managed to find its feet largely due to the taming of the burning Crude prices that had nearly roughed up the entire world. One can see from the chart below that the sector was outperforming the Oil till March 2022 till they exchanged hands.

However, the interesting part to note is that that Oil topped and the Auto sector bottomed in the same month resulting in some sanity returning to the prices. While the Oil continues to outperform the Auto space, the Auto sector seems to be catching up.

There are couple of reasons that has helped trigger a recovery in the Auto sector. Apart from the Crude Oil the government introduced a new scrappage policy that was rolled out from April 1st this year helping to control pollution as well as inducing more sales. Recently, the government announced reduction in excise duty on petrol by a record Rs. 8 per litre and that on diesel by Rs. 6 per litre. Further, it also cut import duty on raw material of steel and plastic and increased export duty on iron ore and steel intermediates.

Such measures will bring down the domestic prices of key inputs thereby softening the prices.

Meanwhile on the charts we note that the trends are finally coming out of the closet. Some steady upward traction seen over the past few sessions looks to be sustaining. Despite hiccups seen across various sectors the Auto sector seems to be holding on and producing some strong recovery in prominent names.

If you take a look at the monthly performance of the Auto sector we can note that the leaders have performed quite well. We assessed the situation over the last one month and find there has been a sizeable action seen in the companies from the two wheeler segment.

With names like Bajaj Auto (Up by 4 %), Hero Motocorp (Up by 11 %) and TVS Motor (Up by 12%) doing reasonable well.

From the four wheeler segment we are noting that only Mahindra & Mahindra (Up by 12%) shoing some spirited upside.

The trends looks set to continue in the current month with positive tailwinds that are emanating in this sector and hence one should be looking at these names to take the lead for participating in trading or as a multi- day play.