Metal sector had a fantastic dream run from April 2020 to April 2022 with Nifty Metal Index registering a historic high. One of the primary reasons was China turned into an importer of steel, aluminium, copper and iron ore as it embarked on an aggressive infrastructure drive. This trend helped the Indian metal sector thrive for the last so many months.

In its glory days the prominent metal counters reported a strong jump in exports at over 50% of total sales in the first quarter largely due to upbeat demand from China. While the rest of the world remained subdued China was enhancing its capacities. The rising demand from a commodity hungry country helped the stock prices escalate at a much faster pace.

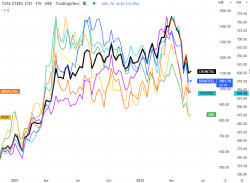

However , after growing three fold from COVID -19 lows the index had reached a point of exhaustion. On closer observation the fuel seemed to be drying up in the Metal sector right from start of 2022. The Relative Strength comparison seen here gave us some perspective that the trends were reaching a point of exhaustion and it was best to scale down the participation.

As they say “All good things must come to an end…” the index started its downward descent since April. Apart from Hindalco, Jindal Steel and JSW Steel which had displayed some exuberance the rest of the stocks began to underperform the Metal Index. By mid-April, they too started losing their sheen. There were some periodic attempts to revive until the announcement on May 23 that broke the back of iron ore and some steel intermediaries.

The government imposed hefty export duties on crucial steel-making raw materials like iron ore and pellets. Export duty on iron ore has been hiked to 50 percent across all grades from 30 percent for lumps, while that on pellets has been imposed at 45 percent from nil earlier, making exports unviable. The development, seen as extremely negative, has brought in broad-based multiple de-rating for the sector stocks.

If 2008 is any cue, the steel sector could be in for severe pain in the next one year. A similar incident happened in 2008 when the then UPA government imposed export duty to curb inflation as steel prices had crossed $1000 per tonne in wake of massive global liquidity and strong demand.

Jindal Steel & Power fell 15 percent, the most since January 2008, Tata Steel was down 12 percent, the biggest drop since August 2015, JSW Steel 11 percent, its highest loss since May 2020 and SAIL was down 11 percent, the lowest it has been since May 2020.

NMDC was trading 10 percent lower, its biggest fall since August 2020, Vedanta was down 6 percent and Hindalco Industries 5 percent. The NSE metal index was down nearly 25 percent from April highs, its biggest fall in two years.

While the measures were taken by the government to recalibrate the prices they have definitely created some headwinds for the sector. The road ahead is going to be fraught with hesitation as the domestic as well as international triggers lead by a sharp reduction in demand, the dollar Index rising to 34-year high and supply exceeding demand are the major reasons slide in metal stocks.

Now as an attempt is made for a rebound the constant supply at higher levels that emerge underlines the fact that the bearishness would continue to surface. The sector is now drifting into more of a trading nature than a positional play.

The recovery is not ruled out but the time taken would be significant as the participants try to co-relate and establish the need to initiate a position.